Alright folks, listen up! Zhongtai Securities just dropped a hot take, and I’m here to amplify it. In this era of ‘equivalent tariffs’ – let’s be real, it’s a game changer – bank stocks are flashing a serious ‘income’ signal. Forget chasing hype, it’s time to chase dividends!

They’re explicitly advising investors to seriously consider banking stocks, pointing to the major players, China Merchant Bank, and solid, strategically positioned city commercial banks. This isn’t some fly-by-night recommendation; it’s grounded in fundamentals.

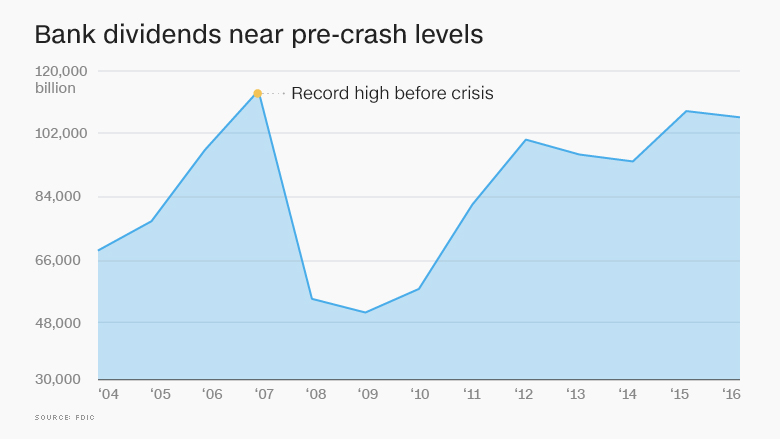

Here’s the kicker: we’re seeing a potential inflection point in the upward trend of government bond yields. Translation? Bank stocks, already undervalued, are now looking ridiculously attractive from a dividend perspective. It’s simple math, people!

Let’s break down the core strategy. There are two distinct investment lanes to explore here:

Firstly, focus on those behemoth, high-dividend yielding large banks. These are the stalwarts, the cash cows, the reliable income generators.

Secondly, don’t sleep on the regional city commercial banks. Look for those with strong local advantages and a clearly defined, robust growth trajectory. These are the hidden gems.

Knowledge Point Expansion: The Power of Bank Dividends in a Changing Market

The attractiveness of bank stocks is elevated by their dividend yield. Yield represents return on investment, specifically dividend paid relative to stock price.

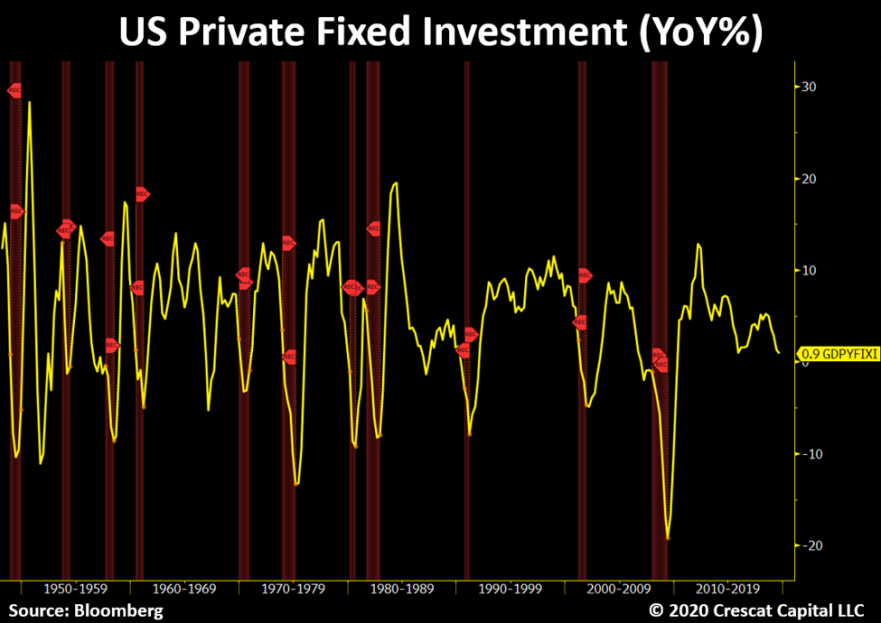

Changing interest rate environments impact bank profitability. Rising yields generally improve net interest margins, boosting earnings. However, rapid increases can also create economic headwinds.

The “equivalent tariff” policy can influence broader economic activity, affecting loan demand and overall banking sector health. Careful consideration of macro factors is key.

Strategic positioning matters immensely, especially for city commercial banks. A strong local presence fuels stability and faster, more sustainable expansion.

Ultimately, diversifying within the banking sector—large caps and regional players—is a smart, savvy move in today’s market.