Okay, crypto fam, let’s break down what’s really happening on Binance Futures. The last 24 hours have been a whirlwind, and the numbers don’t lie: BTC/USDT, ETH/USDT, and SOL/USDT are absolutely crushing it in terms of trading volume on the USDT-margined contracts. Honestly, it’s a good sign to see activity picking up again!

Let’s dive into the specifics. Binance data shows we’ve seen significant action in OM/USDT and XRP/USDT as well. But those top three – Bitcoin, Ethereum, and Solana – are really driving the bus.

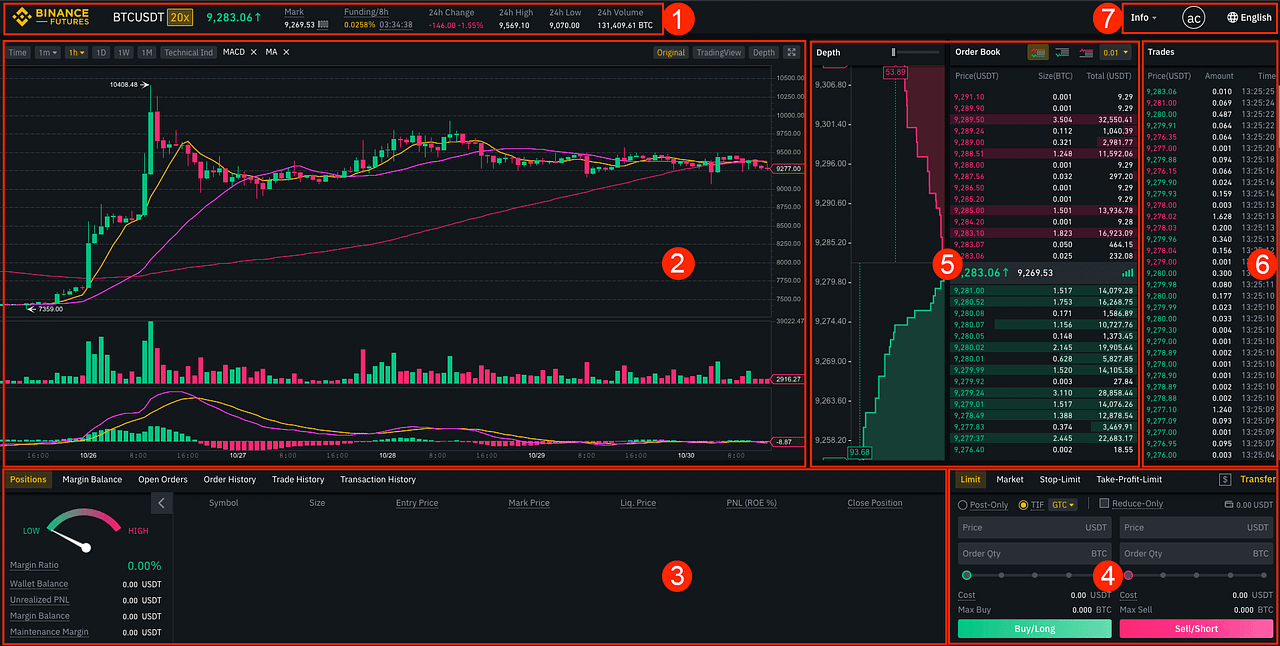

Now, some numbers for the nerds (like me!). BTC/USDT perpetuals show a Long/Short ratio of 0.92, indicating a slight lean towards shorts, but with longs holding a solid 47.89% of the positions. Funding rates are positive at 0.0071% – meaning shorts are paying longs. It’s a subtle hint of bullish pressure.

ETH/USDT is looking seriously bullish with a Long/Short ratio soaring to 2.67! A massive 72.73% of traders are betting long, and the funding rate remains basically flat at 0.0000%. This is leverage at its finest, people!

SOL/USDT continues to impress with a Long/Short ratio of 1.87 and 65.1% long positions. Funding rate is up a bit at 0.0023% showing some positive sentiment.

Let’s talk about funding rates: these rates represent the periodic payments exchanged between long and short positions to anchor the perpetual contract price to the underlying spot market. Positive funding rates indicate long positions are paying short positions, signaling bullish market expectations, while negative rates suggests the opposite. Understanding these rates is crucial for gauging market sentiment and making informed trading decisions.

Keep in mind, fluent traders, these ratios are a snapshot in time. Markets are dynamic, and things can change in a heartbeat. But this data clearly paints a picture of renewed interest, and perhaps, a budding bullish trend. Don’t ape in blindly, do your own research, and trade responsibly, but this is certainly something to watch.