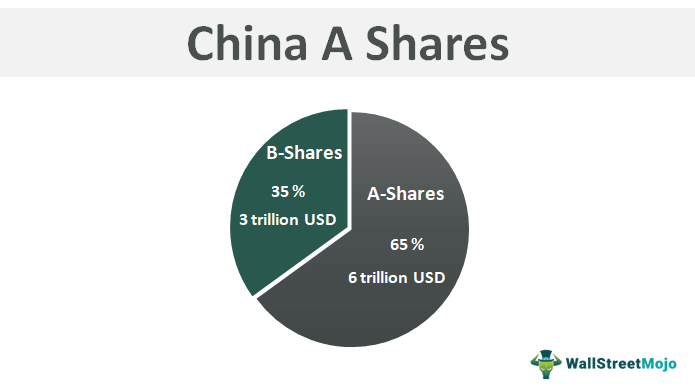

Friends, followers, let’s talk A-shares! The market is buzzing, and for good reason. According to a new report from CICC, we’re looking at a potential ‘booming reopening’ after the Labor Day holiday. Why? Let’s break it down.

Photo source:www.wallstreetmojo.com

First quarter earnings are showing signs of improvement. That’s always good news. More importantly, the tariff anxieties that were weighing on investor sentiment have eased a bit over the holiday. And while we were chilling, Hong Kong and US stocks actually performed quite well – a positive spillover effect we can expect. This confluence of factors is creating a surprisingly optimistic backdrop for A-shares.

So, where should you be looking to deploy capital? CICC’s recommendations are on point.

Knowledge Boost – Understanding the Playbook:

Firstly, focus on sectors experiencing genuine recovery and are relatively shielded from the tariff drama. AI is a prime example!

DeepSeek’s advancements are turbocharging the whole AI industry. Investing in the hardware and infrastructure powering this revolution—think cloud computing and high-performance computing—is critical.

Don’t stop at the foundations; applications like robotics and autonomous driving are also major growth areas. These are the trends to ride, people!

Secondly, let’s get defensive. Seek out companies with strong cash flow and limited exposure to external demand. We’re talking utilities like hydropower, telecom giants, and the stalwarts of the food and beverage industry.

These are your ‘safe havens’ in uncertain times. They provide stability and dividends – exactly what you need in a volatile world. This isn’t about chasing hype; it’s about building a resilient portfolio. Don’t sit on the sidelines – prepare to capitalize on this potential rally!