Alright, let’s talk about something serious hitting the high-end auto market in China. Cui Dongshu, Secretary-General of the China Passenger Car Association (CPCA), just dropped some numbers, and they aren’t pretty. We’re looking at a dramatic 39% year-on-year dive in auto imports for the first three months of 2025, totaling only 95,000 units.

Photo source:www.mordorintelligence.com

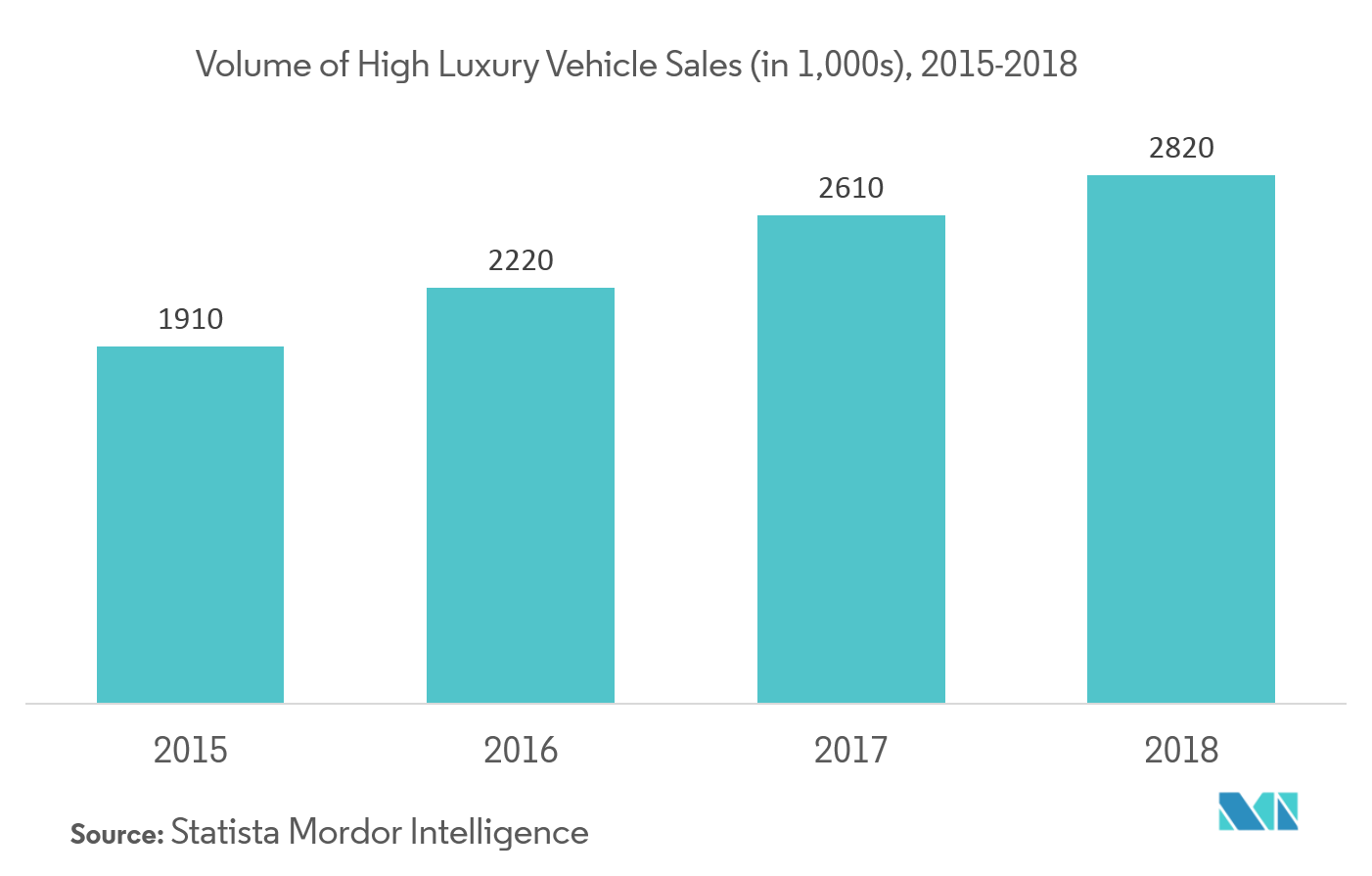

This isn’t a hiccup; it’s a trend. Imports peaked in 2017 at a robust 1.24 million vehicles, and have been consistently declining at around 8% annually – a slow bleed. 2023 saw a paltry 800,000 units, and 2024 didn’t fare much better at 700,000, representing a 12% decrease.

While March saw a slight easing of the decline, with a ‘modest’ 27% drop to 39,000 units, don’t be fooled. This isn’t a recovery. It’s a temporary pause in a downward spiral.

Let’s break down why this is happening. There are multiple forces at play.

Firstly, the rise of domestic Chinese EV brands is fierce. Brands like BYD, NIO, and Li Auto are offering increasingly sophisticated vehicles at competitive price points, directly challenging established luxury imports. This is a game changer.

Secondly, economic headwinds within China are clearly impacting consumer spending, especially on big-ticket items like cars. The luxury market isn’t immune to broader economic pressures.

And finally, changes in import policies and tariffs, although subtle, can contribute to fluctuations in import volumes. It’s a complex mix, folks.

This isn’t just bad news for foreign automakers; it’s a major signal about the evolving landscape of the Chinese automotive industry. The shift is happening now, and the brands that don’t adapt will be left in the dust. Buckle up, this is going to be an interesting ride.