Alright, folks, let’s break down what happened in the markets today. We saw a pretty decent rally across the board, but don’t let it lull you into a false sense of security. There’s nuance here, and ignoring it is a recipe for disaster.

Photo source:www.taiwannews.com.tw

First up, Asia. China’s Shanghai Composite edged up 0.28%, while Shenzhen truly popped, gaining a solid 0.93%. The ChiNext, tracking smaller, growth-focused companies, was the real winner, soaring 1.65%. However, the STAR 50, focused on tech innovation, dipped slightly – a little warning sign, maybe?

Across the water in Hong Kong, both the Hang Seng and the Hang Seng Tech Index managed modest gains.

Now, let’s jump to Europe. Germany’s DAX led the charge, climbing over 1%. Italy’s FTSE MIB absolutely exploded with a 1.7% jump – someone’s feeling optimistic there! The UK’s FTSE 100, however, was a bit of a drag, slipping slightly.

And finally, America. The Dow, S&P 500, and especially the Nasdaq all finished strong. Tech continues to be a driving force, with the Nasdaq up over 1%.

Let’s talk about what’s driving this, and why you should be cautious.

Firstly, inflation data continues to be mixed. While cooler-than-expected figures are fueling rallies, the Fed isn’t about to throw in the towel just yet.

Secondly, earnings season is in full swing, and the market is reacting wildly to individual reports – good news gets amplified, bad news gets punished.

Thirdly, geopolitical risks haven’t magically disappeared. They’re lurking in the background.

Understanding Market Indices:

These indices aren’t just random numbers; they’re snapshots of broad market sentiment. The Shanghai Composite reflects the performance of companies listed on the Shanghai Stock Exchange.

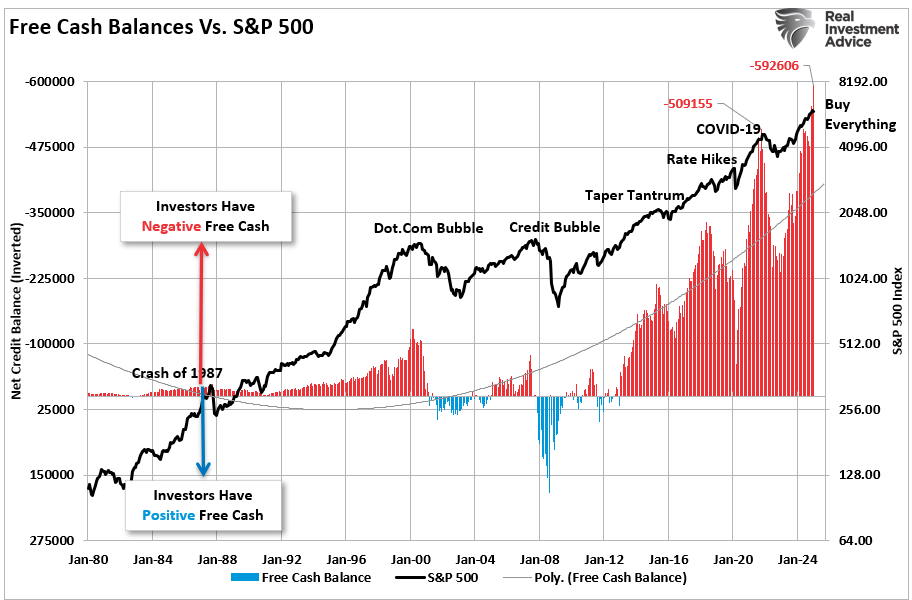

The S&P 500, a benchmark for U.S. equities, represents 500 of the largest publicly traded companies in America.

The Nasdaq Composite is heavily weighted toward tech stocks, making it a key indicator of the tech sector’s health.

Don’t chase rallies blindly. Do your homework, understand the risks, and protect your capital. This is a volatile environment, and staying disciplined is crucial. Don’t be a hero!