Buckle up, folks, because the market is sending some seriously unsettling signals. Gold has exploded, rallying a staggering 30% – a move that historically doesn’t happen in a healthy economy. This isn’t just a ‘safe haven’ play; it’s a flashing red warning light mirroring potential chaos in the equity markets.

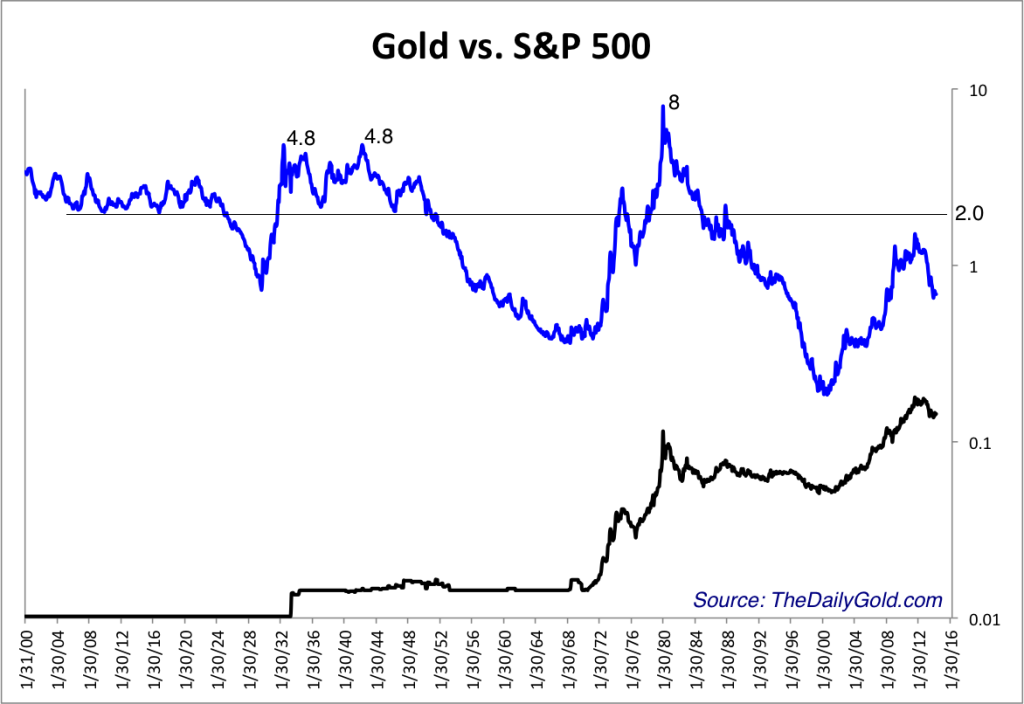

Let’s be blunt: the correlation between gold’s ascent and the brewing anxieties surrounding equities is no coincidence. Are we headed towards a scenario where the S&P 500 plunges to a 1:1 ratio with gold? It’s a frightening thought, but one that’s gaining traction among seasoned analysts.

Gold is traditionally considered a hedge against inflation and economic uncertainty. When investors lose faith in traditional assets like stocks, they often flock to gold, driving up its price.

This isn’t the first time gold has surged during times of market stress. The 2008 financial crisis, for example, saw a significant rise in gold prices as investors sought safety.

The potential for a 1:1 S&P 500 to Gold ratio would signify a dramatic loss of confidence in the stock market and a flight to safety. It’s an extreme scenario, but not entirely outside the realm of possibility given current conditions.

Now, let’s talk oil. Analysts are whispering about a potential bottom for crude around the $X per barrel mark – a level that could either provide support or become a painful ceiling. As for gold, the next major resistance level to watch is… (Click to read the full analysis for specific price targets and a deeper dive into the forces at play!). This is a moment for calculated moves, not panic. Stay informed, stay vigilant, and protect your portfolio.