Alright folks, buckle up, because the pre-market for major Chinese stocks listed in the US is looking rough. We’re seeing a serious sell-off, and frankly, it’s starting to feel a little panicked. Alibaba (BABA.N) is taking a brutal 5% hit, Pinduoduo (PDD.O) isn’t far behind with a 4.5% drop, and NetEase (NTES.O) is down 3%. Baidu (BIDU.O) is shedding 4.2%, and even JD.com (JD.O) is caught in the crossfire, falling 4.1%.

What’s driving this? Well, a cocktail of factors, really.

Understanding ADRs (American Depositary Receipts): These aren’t directly shares in the Chinese companies. They represent ownership, allowing US investors to easily trade. They are subject to both US and Chinese market factors.

The Regulatory Shadow: Ongoing regulatory uncertainty in China is ALWAYS a lurking threat. Investors hate uncertainty, and this is a big dose of it. Concerns about increased government oversight keep dragging down sentiment.

Macroeconomic Headwinds: Global economic worries – inflation, rising interest rates – aren’t helping anyone, and Chinese tech is especially sensitive.

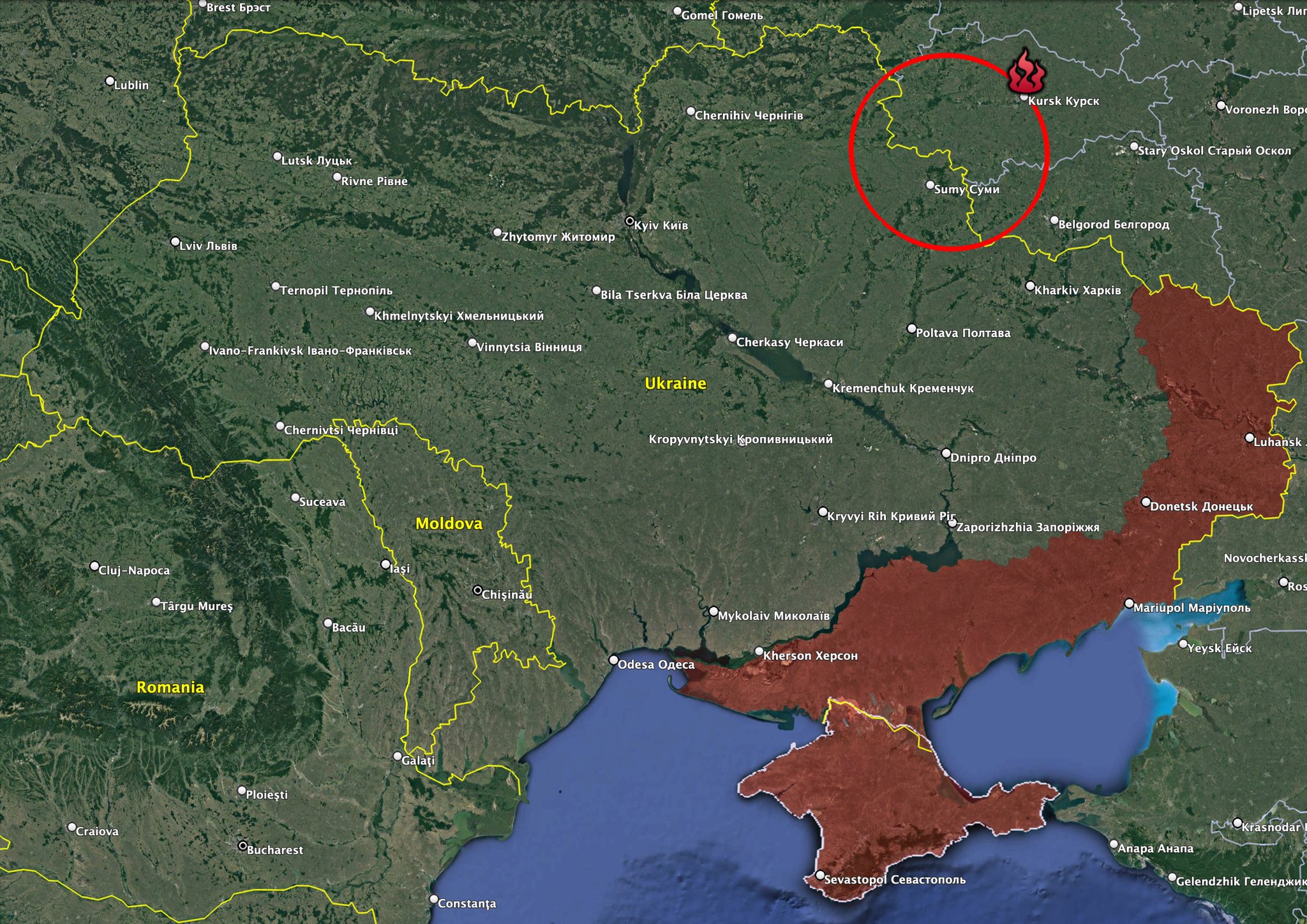

Geopolitical Tensions: Let’s be real, the constant friction between the US and China doesn’t exactly inspire confidence, does it? These companies often find themselves in the middle of it.

Honestly, this feels like a bit of an overreaction, but markets are driven by emotion as much as logic. I’m watching this closely. Don’t panic sell everything, but definitely be cautious. This could be a buying opportunity… or it could get worse. Stay tuned!