Alright, folks, buckle up! Something big is brewing in the gold market, and it’s way more profound than just central banks adding to their reserves. Yes, they’re buying—but frankly, that’s just window dressing. The real game-changer is the sheer chaos of global policy uncertainty.

We’re talking about a complete re-pricing of gold’s fundamental role as a financial asset. For years, it’s been treated like a shiny trinket, a hedge against moderate inflation. But now? We’re staring down the barrel of potentially devastating economic scenarios.

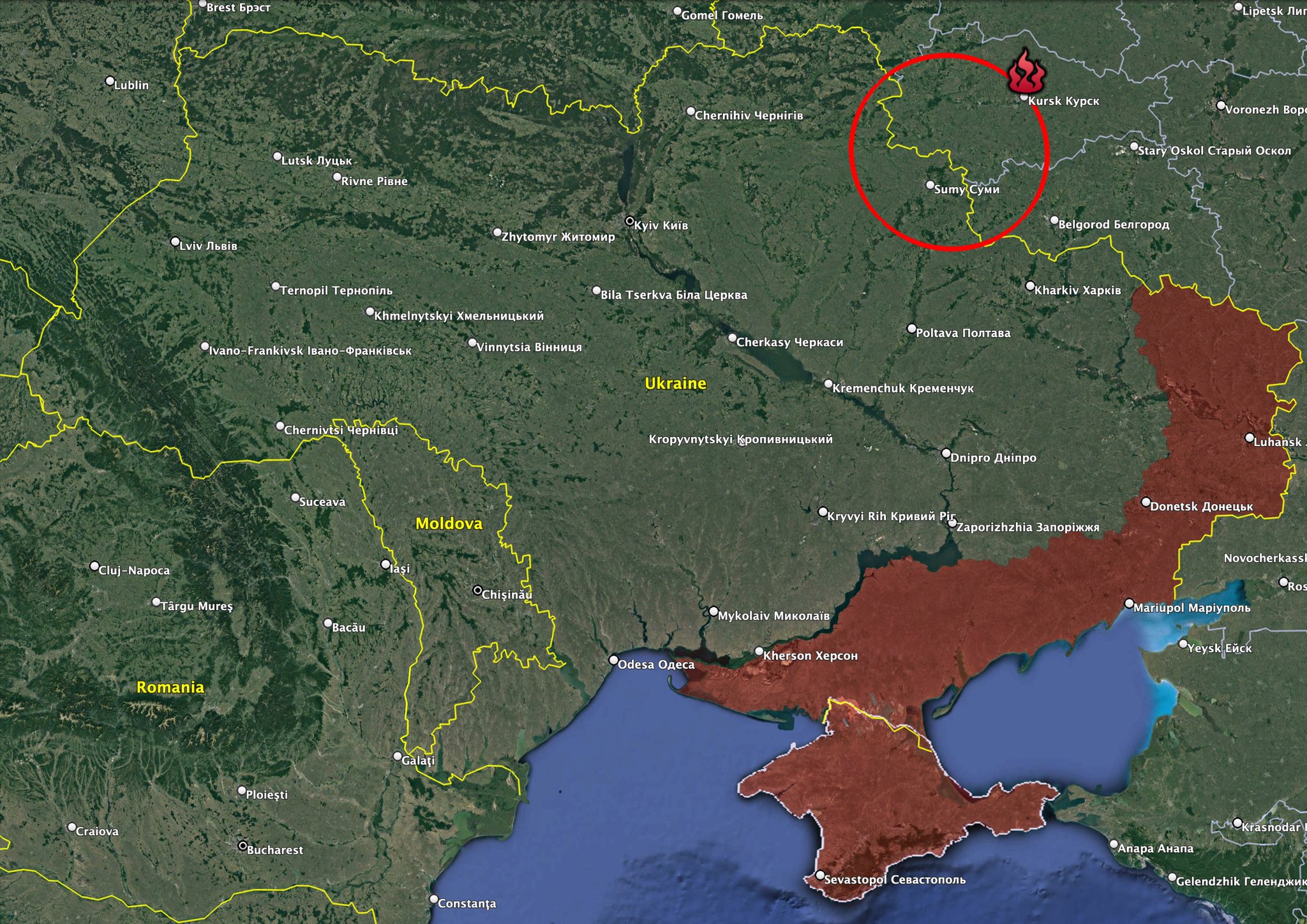

Think about it: geopolitical hotspots flaring up, insane levels of debt, and central banks completely losing control of the narrative. This isn’t about ‘if’ things will go wrong—it’s about when, and how bad.

Knowledge Point Expansion:

Gold’s traditional appeal stems from its scarcity and historical role as a store of value. It doesn’t rely on the solvency of any government or institution.

Central bank gold purchases signify a shifting attitude toward risk management, but they aren’t the primary driver here. Institutional and individual investors are waking up.

Policy uncertainty fuels gold’s price. When faith in traditional financial systems erodes, investors seek ‘safe havens’ like gold.

This re-pricing means we’re looking at gold as a crucial component of portfolio resilience, not just a speculative play. It’s a declaration of distrust, frankly, and it’s going to get messy. Don’t be caught flat-footed – seriously!

This isn’t your grandma’s gold rush. It’s a desperate scramble for stability in a world that’s rapidly losing its damn mind. Get educated, do your research, and protect your wealth. This is not financial advice, just a very loud warning.