Hold onto your hats, folks! Donald Trump is doing it again. He’s thrown a grenade into the Republican party’s carefully constructed narrative, suggesting a hike in the top individual income tax rate to 39.6%. Yes, you read that right. The former president, the champion of tax cuts, is now advocating for… higher taxes!

This isn’t just a slight tweak, it’s a direct challenge to decades of Republican orthodoxy. The plan, apparently, is to use the increased revenue to fund his ambitious economic agenda. But let’s be real, this move is sparking a firestorm within the GOP, and the debate is fierce.

This move has the potential to reshape the political landscape. Is Trump showing a surprising willingness to play political hardball? Or is this a strategic maneuver designed to gain leverage in negotiations? The answer is probably a bit of both.

Diving Deeper: Understanding the 39.6% Tax Rate

The 39.6% top marginal tax rate isn’t new. It was in effect for many years before the 2017 tax cuts championed by Trump himself.

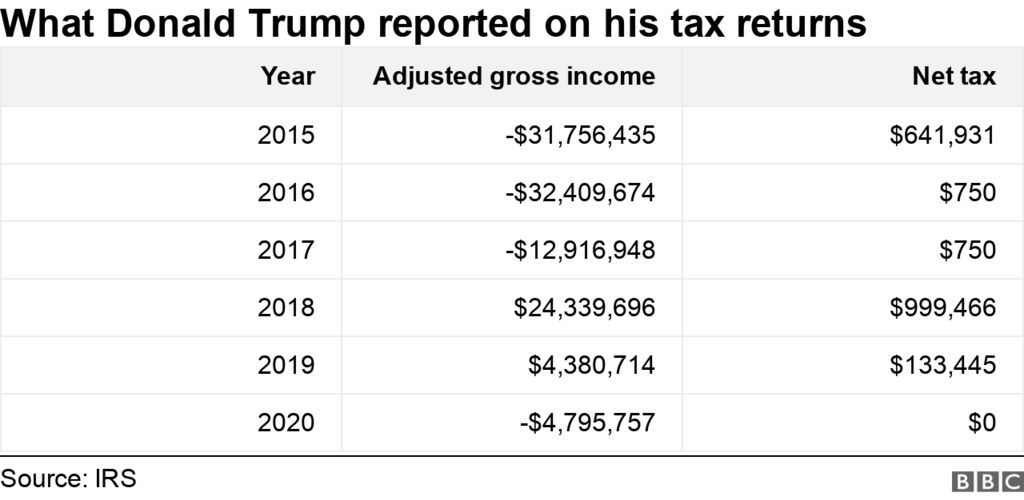

Historically, this rate applies to the highest earners – typically individuals making over a certain income threshold (around $400,000 for single filers).

The rationale behind a progressive tax system, like one employing a 39.6% top rate, is to redistribute wealth and fund public services.

Critics of lowering the top rate argue it disproportionately benefits the wealthy and exacerbates income inequality. Trump’s current proposal, while surprising, acknowledges this economic reality.

This isn’t just about numbers, it’s about power dynamics and how a president wields influence. The coming weeks will reveal whether Trump can rally his party behind this unorthodox approach.