Alright, folks, let’s cut through the noise. A recent report from Citic Securities is sending ripples through the autonomous driving sector, and it’s a development we need to pay very close attention to. The message is clear: Beijing is tightening the screws on industry standards – and that’s a good thing, especially for the frontrunners.

Photo source:siminnatalie.pages.dev

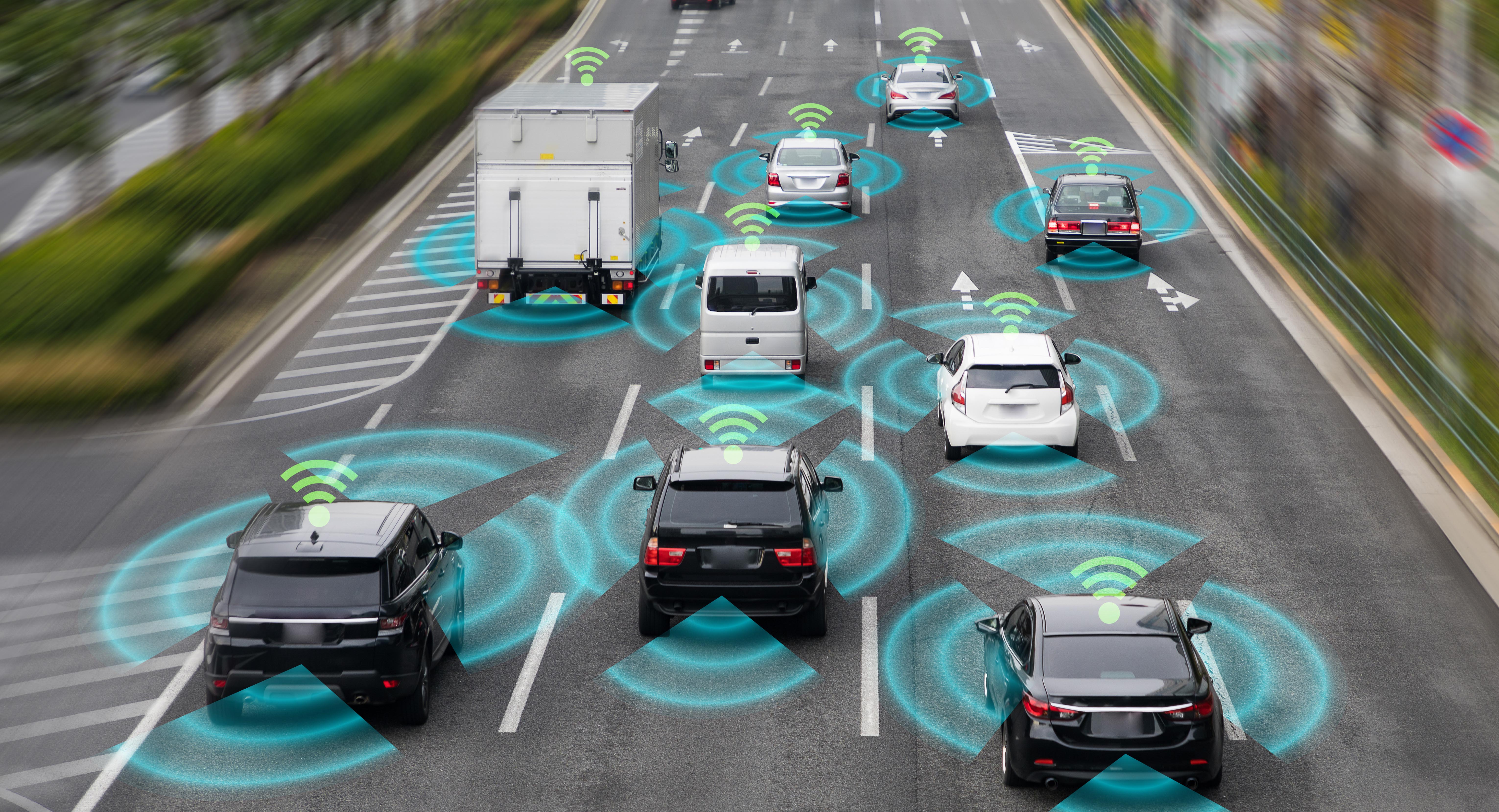

Here’s the breakdown. We’re going to see a massive push towards maturity and, crucially, safety. Companies are going to be prioritizing rock-solid tech, not just flashy demos. Expect automakers to streamline their hardware and software – no more Frankenstein builds. They’ll be laser-focused on collecting the data needed to prove their systems are reliable.

Now, let’s talk tech. LiDAR, previously seen as a luxury, is poised for a surge in adoption. Why? Because it significantly boosts system robustness. This isn’t just about bells and whistles; it’s about building systems that can handle real-world complexity.

Furthermore, Level 3 conditional automation – the sweet spot where the car can drive itself under specific conditions, with human oversight – is likely to get a major boost in investment. This is where clear responsibility boundaries are essential, and regulators are rightly demanding that clarity.

Let’s dig a little deeper into why this development is so significant:

Autonomous driving relies heavily on sensor technology. LiDAR provides detailed 3D mapping, crucial for obstacle detection.

L3 automation represents a pivotal step towards full autonomy. It requires sophisticated AI and robust safety protocols.

The need for clear responsibility is paramount. Determining fault in accidents involving autonomous vehicles is a complex legal challenge.

Increased regulation fosters trust. Consumer confidence is vital as these technologies become more prevalent.

As always, the winners will be the companies that have already invested heavily in these areas. Citic Securities is rightly recommending a focus on the leading players in the autonomous driving space. This isn’t a space for dabblers; it’s for serious, well-funded firms. Buckle up – the ride is about to get interesting.