Alright crypto fam, buckle up! The latest jobs report threw a wrench in the Fed’s plans, and Wall Street is scrambling. The US added 177K jobs in April – way more than the predicted 130K. This seemingly good news? It’s actually a headache for those hoping for a quick rate cut.

“Fed whisperer” Nick Timiraos is saying a June cut is looking less likely. With only one more jobs report before the June meeting, the Fed isn’t feeling the pressure to act, and honestly, good riddance to a rushed decision.

But don’t despair! Both Barclays and Goldman Sachs now anticipate a July cut, pushing their previous expectations back from June. So, a cut is still on the table, it’s just taking the scenic route.

Speaking of Goldman Sachs, they’re diving deeper into the digital asset world, folks! They’re planning to ramp up trading, explore crypto lending, and focus on tokenization and collateral liquidity. Finally, some REAL money coming into the space. These guys are listening to their clients, and the clients WANT crypto!

Here’s a wild one: Strategy Corp is planning to raise a whopping $84 billion over the next two years to buy Bitcoin. Yes, you read that right. 84 billion. Though they took a significant loss last quarter, they’re clearly doubling down on their bet. Crazy times.

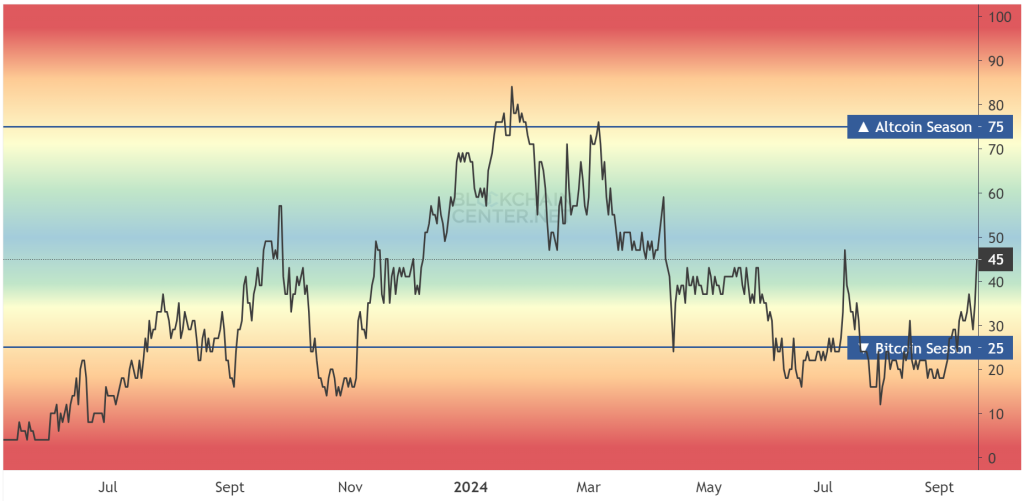

And for all you altcoin lovers? Arthur Hayes is calling it: altcoin season is officially here. Get ready for some serious gains, but remember, DYOR – do your own research!

Oh, and just to add to the good vibes, the S&P 500 just hit a nine-day winning streak – the longest since 2004. The markets are feeling optimistic, and frankly, so am I!

Let’s break down tokenization: This process involves representing real-world assets (like real estate, art, or commodities) as digital tokens on a blockchain. It’s a game-changer for liquidity and accessibility.

Collateral liquidity is all about making it easier to use assets as collateral for loans. Think of it as unlocking the value of your holdings and putting them to work.

Why does the jobs report matter? It’s a key indicator of economic health. A strong job market can lead to inflation, which is why the Fed is cautious about cutting rates too quickly. They want a sweet spot: boosting the economy without fueling inflation.