Friends, buckle up. The global financial landscape is getting rockier by the minute, and yesterday/this morning delivered a barrage of headlines that demand our attention. Let’s break it down – brutally honestly, as always.

China is signaling it’s prepping for a more assertive economic stance. Finance Minister Lan Fo’an announced a move towards more proactive macroeconomic policies. Translation: they’re gearing up to counter external pressures, and let’s be real, that pressure is overwhelmingly from the US.

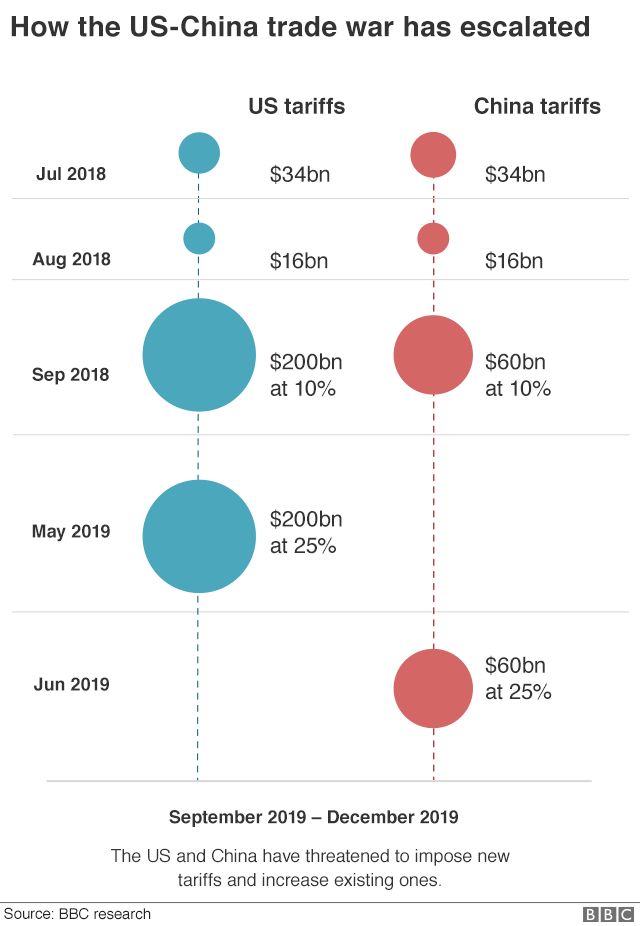

Speaking of the US, forget any whispers of tariff negotiations! Our embassy in Washington clarified – and I quote – there are no ongoing talks, and absolutely no agreements. This is a clear rebuff to any expectations of a quick resolution, particularly after Trump’s renewed demands for “substantial concessions.” It’s a game of chicken, and frankly, Beijing isn’t blinking.

The IMF became a stage for China to call out the US’s tariff obsession. They rightly pointed out the devastating impact these duties are having on emerging markets and developing nations. It’s not just about trade; it’s about global economic stability.

Domestically, President Xi Jinping is doubling down on self-reliance, with a major focus on AI development – intelligently and safely. Meanwhile, Pan Gongsheng didn’t hold back, condemning US tariffs as a wrecking ball to the global economic order. He is, quite rightly, urging for global policy coordination.

On the auto front, car import numbers are down a shocking 39% – a sign of continued economic headwinds, even as others try to spin a more positive narrative.

Let’s move to other important updates:

Understanding PCAOB’s Role: The US Republican plan to dismantle the Public Company Accounting Oversight Board (PCAOB) is deeply concerning. This body is crucial for audit quality and investor protection. Its abolition could lead to a free-for-all in accounting practices.

Geopolitical Flashpoints: The clashes on the Kashmir border between India and Pakistan further add to global uncertainty. And, on the horizon, tensions in the Middle East and Ukraine continue to simmer, with negotiations progressing sluggishly.

xAI’s Big Ambitions: Elon Musk’s xAI is aiming for a massive $20 billion funding round – potentially making it the second-largest startup financing ever. That’s cash, people, and it signals a massive bet on the future of AI.

Finally, the devastating explosion in Iran’s Abbas Port, handling 85% of the country’s container traffic, is a reminder of how fragile global supply chains are. The official cause is still under investigation, but it’s a major disruption to Iranian trade. And despite the chaos, Iranian officials insist energy facilities are unaffected… for now.

The world is a complex, interconnected mess, and we need to stay sharp. Don’t let the noise drown out the signal. Stay informed, trade cautiously, and remember: knowledge is power.