Hold onto your hats, folks, because the latest ADP employment report is… well, frankly, it’s terrifying. We’re talking a measly 62,000 jobs added in April – the smallest gain since July 2024. This isn’t just a miss; it’s a full-on faceplant compared to the expected 115,000. And let’s not even talk about last month’s revised 155,000!

What the hell is going on? This data screams trouble, hinting at a brewing economic slowdown that the Fed seems determined to ignore. Is this the beginning of the end for the ‘soft landing’ narrative?

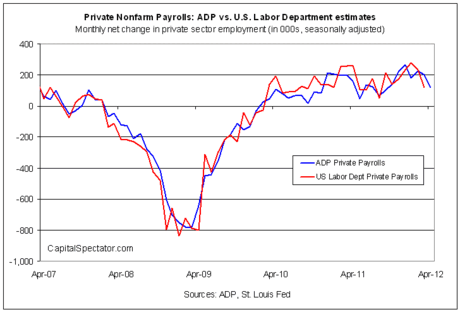

Let’s dig a little deeper. ADP reports, while not a perfect predictor, often foreshadow the official government numbers. This steep decline suggests companies are hitting the brakes on hiring, and fast.

Understanding ADP Employment Reports:

ADP (Automatic Data Processing) publishes a monthly report that estimates the net change in U.S. nonfarm private employment. It uses data from roughly 450,000 businesses, providing a relatively quick snapshot of the job market.

It’s important to note that the ADP report isn’t the same as the official Bureau of Labor Statistics (BLS) employment report, which is released a few days later. However, they often move in the same direction.

This slowdown isn’t isolated. We’ve been seeing cracks in other economic indicators, like weakening consumer spending and a cooling housing market. Put it all together, and you’ve got a recipe for potential disaster. Seriously, someone wake up the Federal Reserve!

While the BLS report is coming, and things could change, this ADP number is a big, flashing red warning sign that we need to pay attention to. Don’t let the optimists lull you into complacency – the economic landscape is looking shaky, to say the least.