Folks, brace yourselves. The swamp just keeps getting deeper. Erik Prince, the infamous Blackwater founder and staunch Trump supporter, is reportedly cutting a deal with the Democratic Republic of Congo. The exchange? Security assistance for mineral wealth.

This isn’t just business; it’s a desperate gamble by Congolese President Felix Tshisekedi, who, in a February letter to Trump, practically offered up Congo’s mineral riches for a lifeline against rebel groups. We’re talking vital minerals needed by US tech companies – a key strategic play, no doubt.

Tshisekedi even dangled mining opportunities for a potential Trump-controlled sovereign wealth fund. The audacity! But let’s be real, this smells like a late-stage desperation move, increasingly common in resource-rich but unstable nations.

Now, here’s where it gets really interesting. While assurances are being given that we won’t be sending in armies of mercenaries (yet!), the very notion of privatized security forces operating in a conflict zone is terrifying. It’s a recipe for disaster.

A Deeper Dive: Congo’s Mineral Wealth and the Geopolitical Chessboard

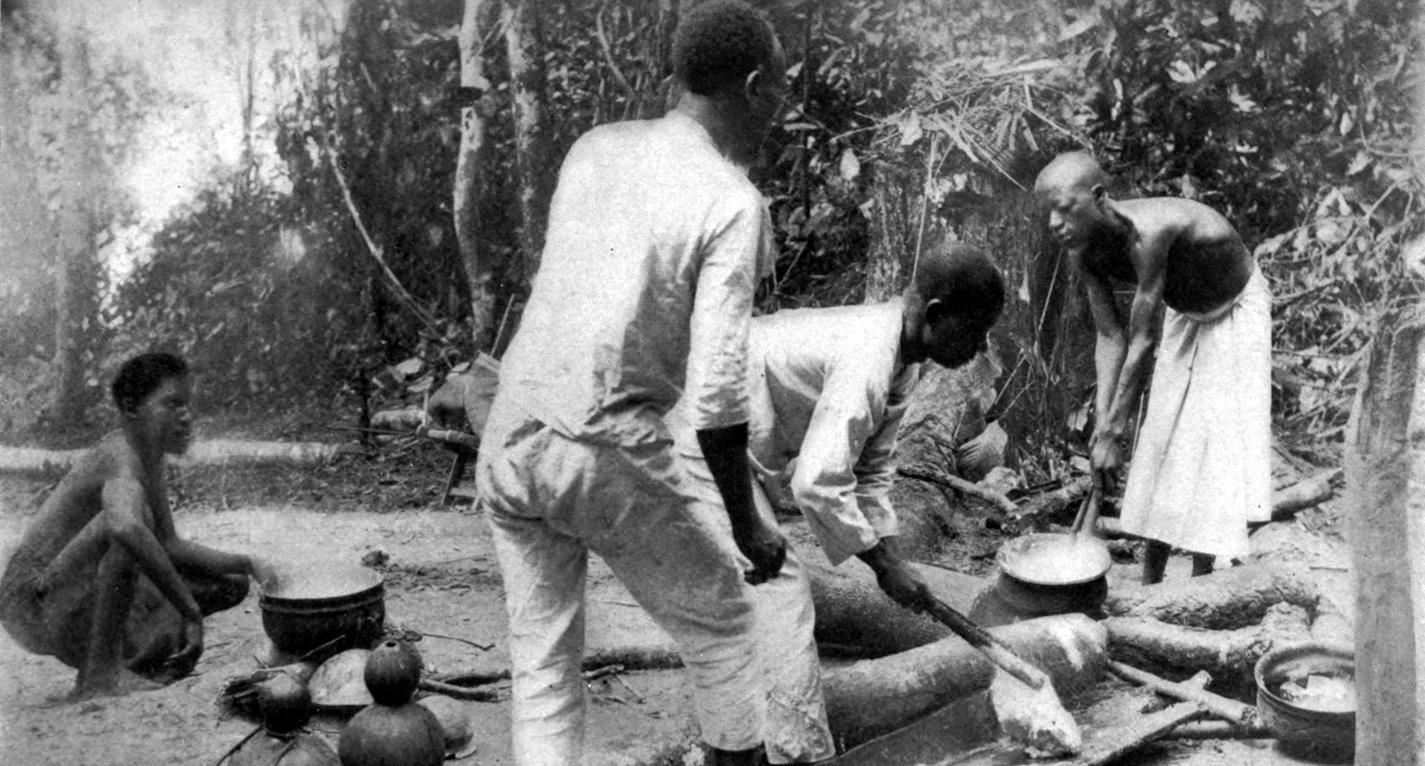

The DRC is unbelievably rich in vital resources. Cobalt, crucial for electric vehicle batteries, is largely sourced from the country.

It also holds significant reserves of lithium, tantalum, tin, tungsten, and gold – all essential for modern tech. This makes it a focal point for global competition.

The security situation remains fragile. Various rebel groups control territories, disrupting mining operations and fueling regional instability.

This deal, if it proceeds, represents a concerning trend: increasingly, nations are outsourcing security, eroded accountability, and potentially worsening conflicts in the quest for resources.

And as if you needed another sign of market jitters, gold briefly dipped below $3290/oz on the news – a clear indication of risk aversion. This is a story to watch closely, folks. It’s a window into the murky world where geopolitics, profits, and instability collide.