Hold the freaking phone, crypto fam! ARK Invest, led by the one and only Cathie Wood, just blew my mind (and probably yours too) with a massive Bitcoin price prediction. Their latest monthly report? They’re now calling for a bull case price of a staggering $2.4 million per Bitcoin by 2030!

Seriously, two-point-four million dollars. That’s not just optimistic; that’s bordering on insane…but in a good way. The previous estimate of $1.5 million now looks downright conservative. Let that sink in.

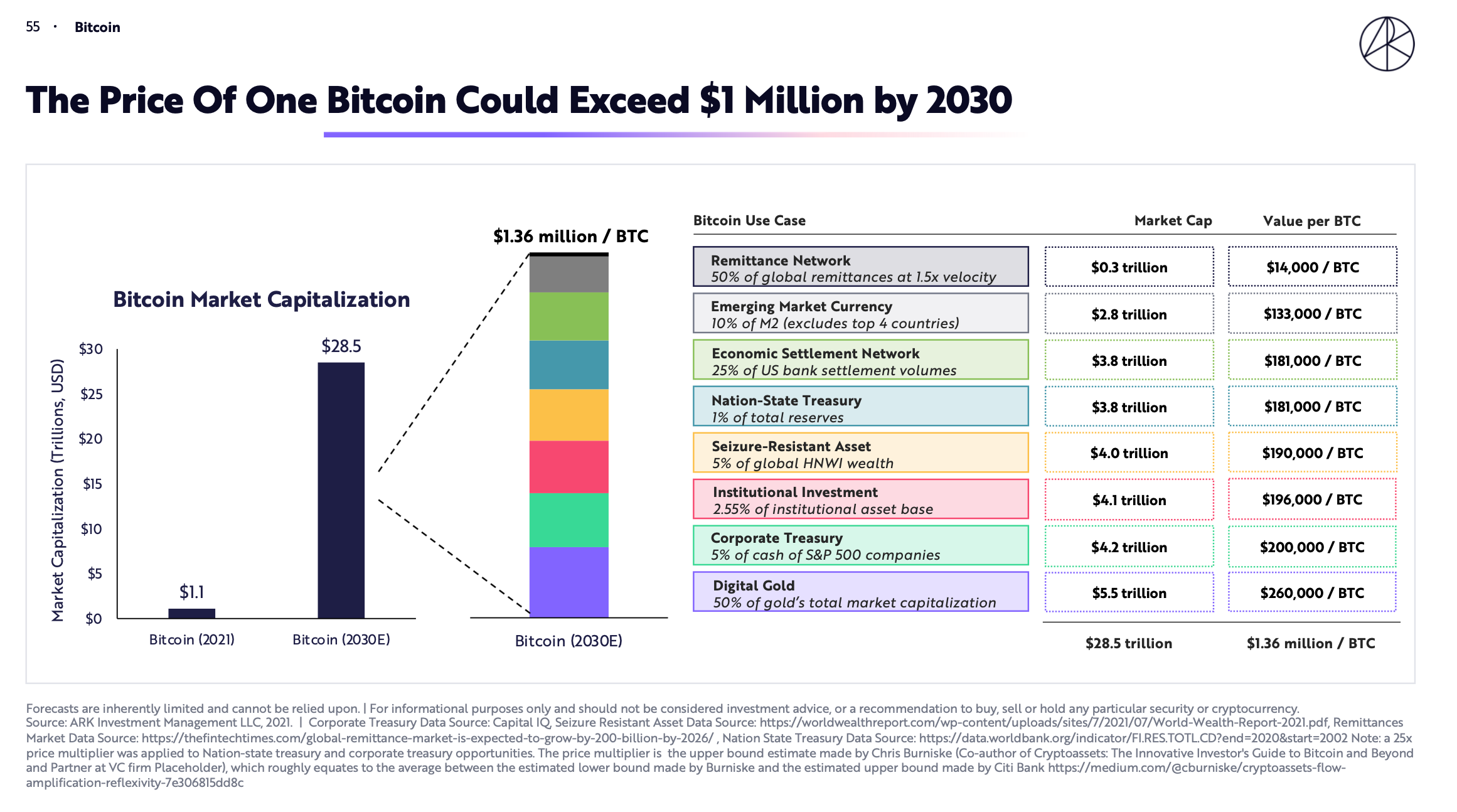

Of course, they’re not painting a purely rosy picture. A ‘base case’ scenario sees Bitcoin hitting $680,000, and a ‘bear case’ dips down to $250,000. But come on, we’re here for the moonshots, right?

So, what’s driving this dramatic upgrade? ARK points to key factors: increasing institutional adoption, and – crucially – the potential for sovereign nations to start stacking sats. This is HUGE.

But it’s not just about demand. ARK also highlighted the vital question of Bitcoin’s scaling capabilities. This house believes Bitcoin’s network evolution is critical for achieving these ambitious price targets.

Let’s break down why this matters (beyond the obvious ‘to the moon’ vibes):

Bitcoin’s scaling challenges, like transaction speed and fees, are ongoing issues. Layer-2 solutions like the Lightning Network aim to alleviate these bottlenecks.

Institutional adoption is the holy grail, bringing massive capital and legitimacy to the space. Think pension funds, endowments, and Fortune 500 companies finally getting in on the action.

Sovereign adoption – nations accepting Bitcoin as legal tender or adding it to their reserves – is a game-changer. It signals a shift in the global financial power dynamic.

These factors are interconnected. Increased adoption requires scaling solutions, and sovereign nations need confidence in the network’s stability and functionality. ARK is betting big on all of these pieces falling into place.