China's futures market opened with a mixed bag today – strong gains in metals & energy contrasted...

China Markets

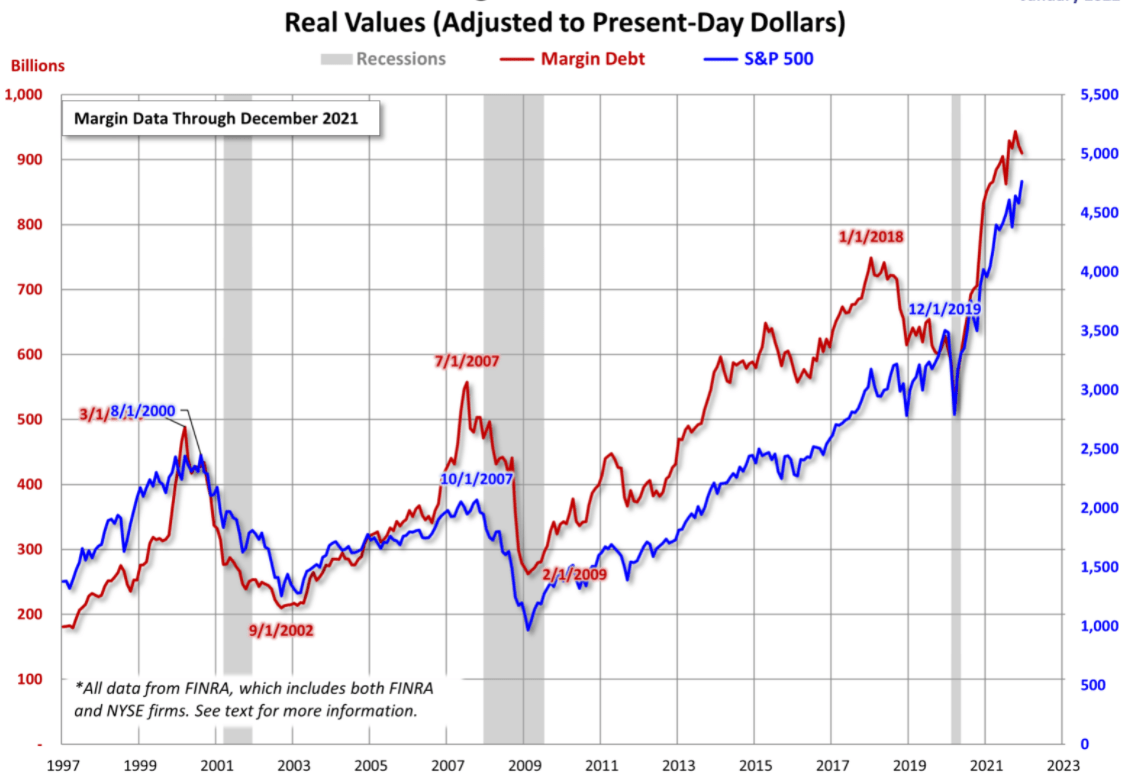

Margin debt in China's stock markets saw a 20.46 billion yuan increase, sparking debate about whether it...

Margin debt across Chinese exchanges decreased by 626 million yuan yesterday. Is this a sign of investor...

Margin debt on Shanghai and Shenzhen exchanges increased by 5.641 billion yuan yesterday. Is this a bullish...

Amperex Technology initiates the first ever block trade on the ChiNext board, opening new investment opportunities and...

CCB Fund is adding another 180 million yuan to their equity holdings, signaling a bullish outlook despite...

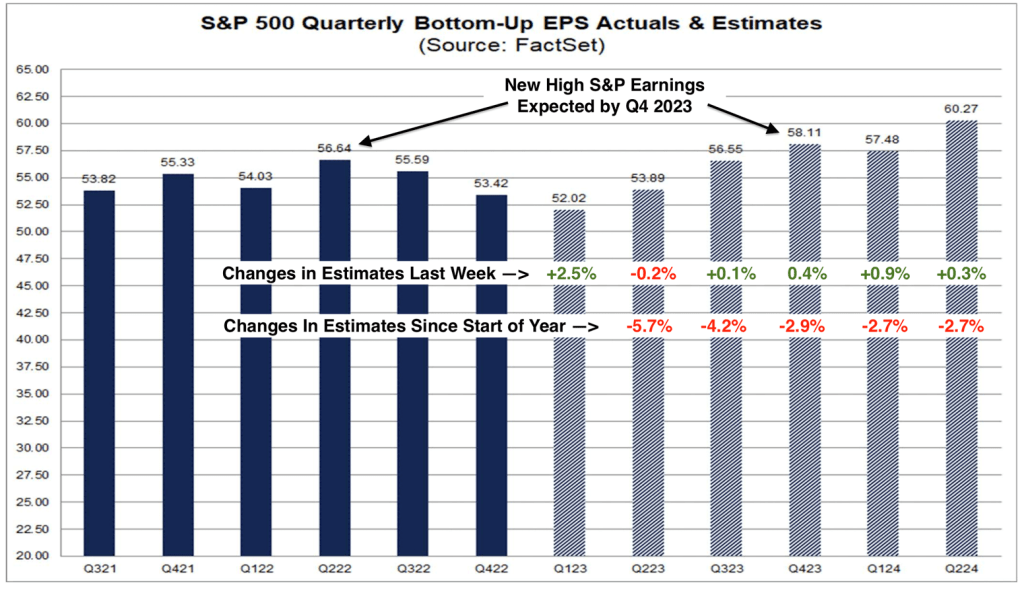

A-share Q1 earnings are showing surprisingly strong pre-release numbers, with 17 companies forecasting profit surges exceeding 600%....

Chinese index futures closed lower midday, with the CSI 300, SSE 50, CZ500, and CZ1000 all experiencing...

Chinese index futures began the day in the red, with major contracts seeing declines. A cautious start...

A-share fintech stocks are experiencing a dramatic surge, with several companies hitting limit-ups. Is this a buying...