Holy moly, people! Fidelity is dropping bombshells, and it’s glorious news for Bitcoin bulls! They’re reporting that exchange Bitcoin supply is plummeting, hitting levels not seen since November 2018. That’s right, folks, we’re talking serious scarcity.

Photo source:www.digitalmarketnews.com

This isn’t some fluke, either. It’s being driven by insane institutional buying. Companies are scooping up Bitcoin left and right, and they’re not stopping anytime soon. We’ve already seen over 425,000 BTC leave exchanges since November 2024 – a frankly ridiculous amount.

And guess what kicked things into hyperdrive? The US election. Post-election, companies added nearly 350,000 more Bitcoin to their coffers! They’re basically printing money by stacking sats. Fidelity anticipates that this trend will accelerate in the near future.

Currently, exchanges hold around 2.6 million BTC, the lowest since 2018, and are estimating companies will purchase over 30,000 BTC each month until 2025. This is not a drill!

—

Understanding Bitcoin Supply Dynamics (A Little Tech Deep Dive)

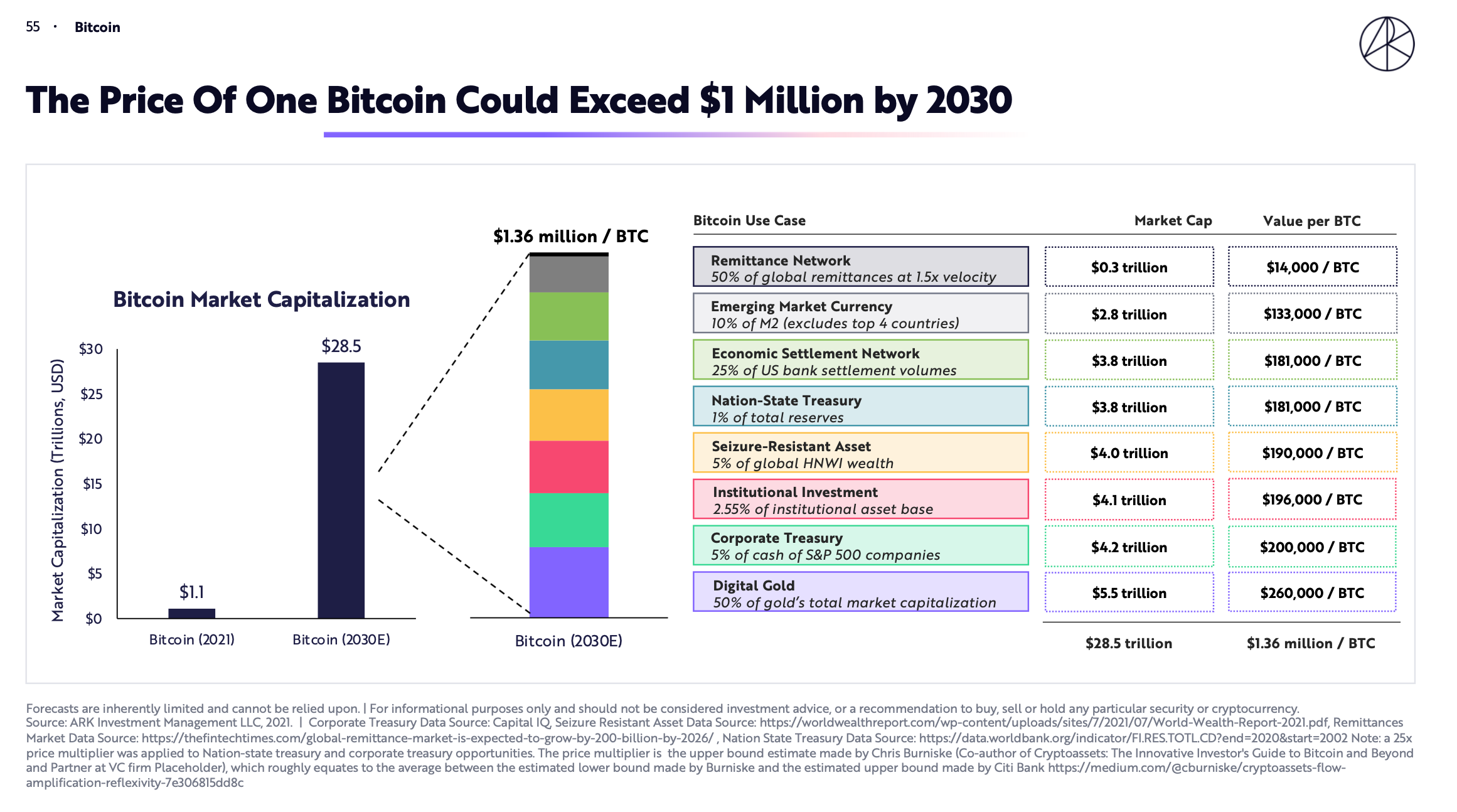

Bitcoin’s limited supply of 21 million coins is a core feature. Scarcity frequently drives up the price. When more coins are held off-exchange, it reduces selling pressure.

Institutional investors like corporations are long-term holders. Their purchases indicate increasing confidence in Bitcoin’s future. This shifts Bitcoin from speculative trading to a store of value.

A reduction in exchange supply makes it harder for traders. It can increase volatility as fewer coins are readily available for purchase and sale.

This current trend points to a significant and sustained demand. It’s strengthening Bitcoin’s fundamental value and positioning it for future gains. It smells like a bull run, folks, and it smells good!