Alright, let’s dissect this. Today’s data shows that margin trading, aka borrowing to buy stocks, ticked up by 20.46 billion yuan across both Shanghai and Shenzhen exchanges. Shanghai saw a modest 2.75 billion yuan increase, while Shenzhen’s jump was a more noticeable 17.71 billion yuan. Currently, total margin debt stands at a hefty 17.94 trillion yuan.

Now, what does this really mean? It’s a complex picture. A slight increase could suggest cautious optimism creeping back into the market, investors starting to deploy capital again. But let’s be real: Margin debt is a double-edged sword.

Let’s break down why this metric deserves close attention:

Margin trading allows investors to leverage their capital, potentially amplifying gains…and losses. It’s essentially borrowing money to invest, increasing exposure to market risk.

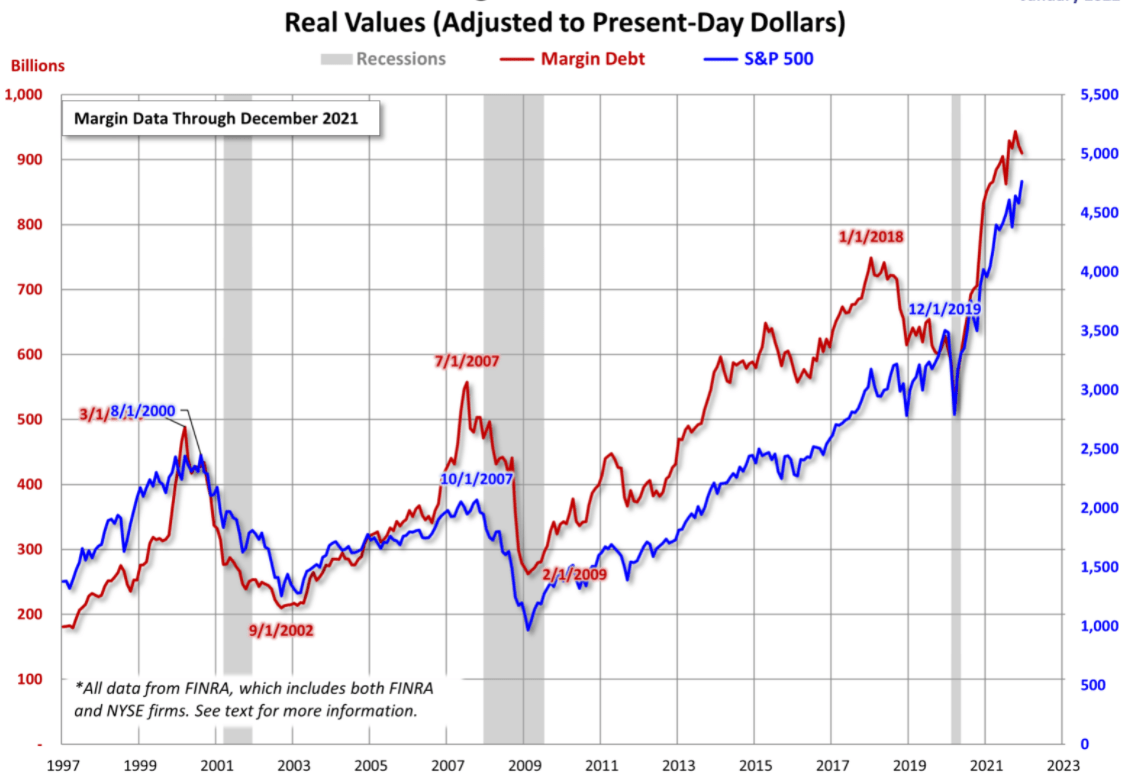

Historically, significant increases in margin debt have often preceded market corrections. Think of it as fuel for a rally, but also a potential accelerant for a downturn.

The Chinese market in particular has seen cycles where excessive margin lending has contributed to volatility and bubbles. We’ve seen this movie before, folks.

Currently, the level isn’t alarming, but it’s a trend we must track. Is this a measured increase driven by genuine conviction, or is it the result of chasing performance and fueled by FOMO (Fear Of Missing Out)? That’s the million-dollar question. Keep your eyes peeled, and remember: prudence is paramount in these uncertain times. Don’t get caught overextended!