Alright, folks, listen up! Bitwise CIO Matt Hougan just dropped a truth bomb that’s gonna shake up the institutional investment world. He’s saying it’s time to radically rethink crypto allocation – bumping it from a pathetic 1% to a hefty 5%! I mean, come on, 1%? That’s chump change!

This isn’t some wild, speculative call, either. The numbers are already backing this up. CoinShares research shows institutional portfolios are already averaging 1.8% in digital assets, with an average allocation reaching 2.5%. The tide is turning, people!

And let’s be real, the ripple effect of Michael Saylor’s $58 billion Bitcoin bet is HUGE. He’s basically screaming from the rooftops that Bitcoin is the future, and companies are listening. Seriously, the guy’s a legend.

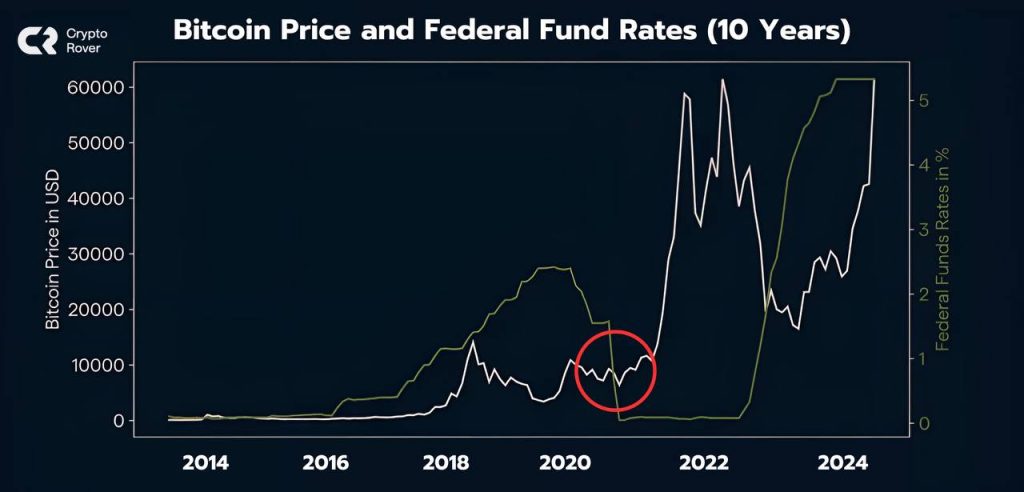

BlackRock’s Jay Jacobs is adding fuel to the fire, pointing out that in this insane macro environment, Bitcoin is actually looking like a safe haven – a legitimate alternative to the traditional stocks and bonds! That’s right, folks, Bitcoin is maturing and being considered as a key tool to hedge against uncertainty.

Let’s delve a bit deeper into why this shift is happening:

Bitcoin’s narrative is evolving. It’s moving beyond “digital gold” and becoming a crucial diversifier.

Increasing adoption by established financial institutions like BlackRock validates the asset class. This creates mainstream confidence.

Macroeconomic factors – like inflation and geopolitical tensions – are driving demand for alternative assets.

Regulatory clarity (eventually!) will unlock even greater institutional investment. Don’t hold your breath, but it’s coming (hopefully!).

Ultimately, Hougan’s call to 5% isn’t just a suggestion; it’s a reflection of the changing landscape. The game has changed, and it’s time for investors to adapt – or get left behind. This is a pivotal moment for crypto, and I, for one, am fully onboard!