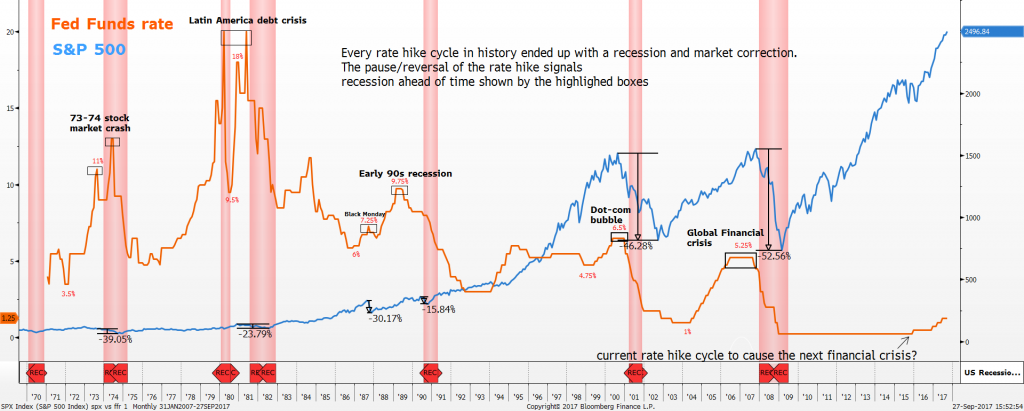

The Bank of Japan (BOJ) just dropped a bombshell in its latest meeting minutes. One member explicitly stated the need for extreme caution when contemplating the next rate hike. Why the sudden hesitation? The escalating downside risks originating from US policy, folks. Let’s be clear: this isn’t some distant concern; it’s a rapidly intensifying threat.

Photo source:www.stocksbnb.com

This isn’t about the BOJ suddenly losing its nerve; it’s about recognizing the sheer power the US Federal Reserve wields over global markets. A misstep in Washington can send shockwaves reverberating across the Pacific. The BOJ knows this.

Let’s quickly break down why this matters. The US Federal Reserve’s monetary policy decisions, primarily interest rate adjustments, directly influence global capital flows. Higher US rates attract investment, potentially strengthening the US dollar and weakening other currencies, including the Yen.

This creates a complex situation for Japan, which relies heavily on exports. A significantly stronger dollar, coupled with a weaker yen, can hurt Japan’s export competitiveness. This dynamic is a key driver of the BOJ’s cautious stance.

Furthermore, a potential US recession, triggered by aggressive rate hikes, would decimate global demand, severely impacting the Japanese economy. The BOJ isn’t prepared to add fuel to that fire.

The implications are significant. It underscores the increasing interconnectedness of global financial systems and the BOJ’s reluctance to act unilaterally in the face of unpredictable US actions. Expect more volatility in the Yen as this situation unfolds. Buckle up, traders!