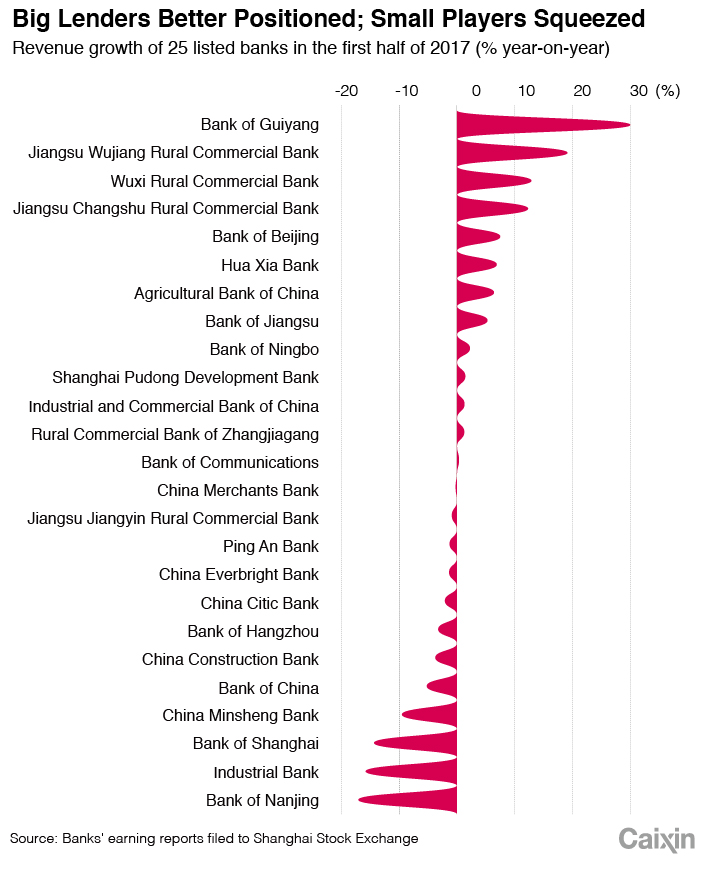

Alright folks, let’s break down what just happened with the FTSE China A50 today, April 11th, 2025. It was a mixed bag, to say the least. We saw real divergence in the banking sector – some names tanked, others held firm. Frankly, it’s a telltale sign of underlying uncertainty, and we need to be paying attention to which banks are feeling the pressure.

The real story of the day, however, unfolded in the semiconductor space. After a somewhat sluggish start, these stocks really came alive in the afternoon. This is crucial. Semiconductors are the engine of future growth, and seeing that kind of momentum late in the session is a positive signal.

Let’s dive a little deeper into what’s driving these trends.

Semiconductors are incredibly sensitive to global demand and technological advancements. A late-day rally often indicates renewed confidence in overall economic prospects.

Banking performance, on the other hand, is frequently tied to investor sentiment regarding China’s economic health and potential policy shifts. Divergence is arguably a warning that fears about economic slowdown are still present.

We need to carefully analyze which banks are underperforming and what’s driving this. Look at their loan books, exposure to risky sectors, and regulatory pressures. That’s where the real clues lie. Remember, don’t just follow the headline; dig into the details!

This isn’t just about today’s numbers. It’s about understanding the underlying narrative, folks. The A50 is a barometer, and right now, it’s flashing a few warning lights alongside some encouraging green shoots.