Alright, folks, buckle up! Citi just dropped a bombshell on ZTE (00763.HK), boosting its target price to a hefty HK$27.5! Let’s break down why this isn’t just another analyst upgrade.

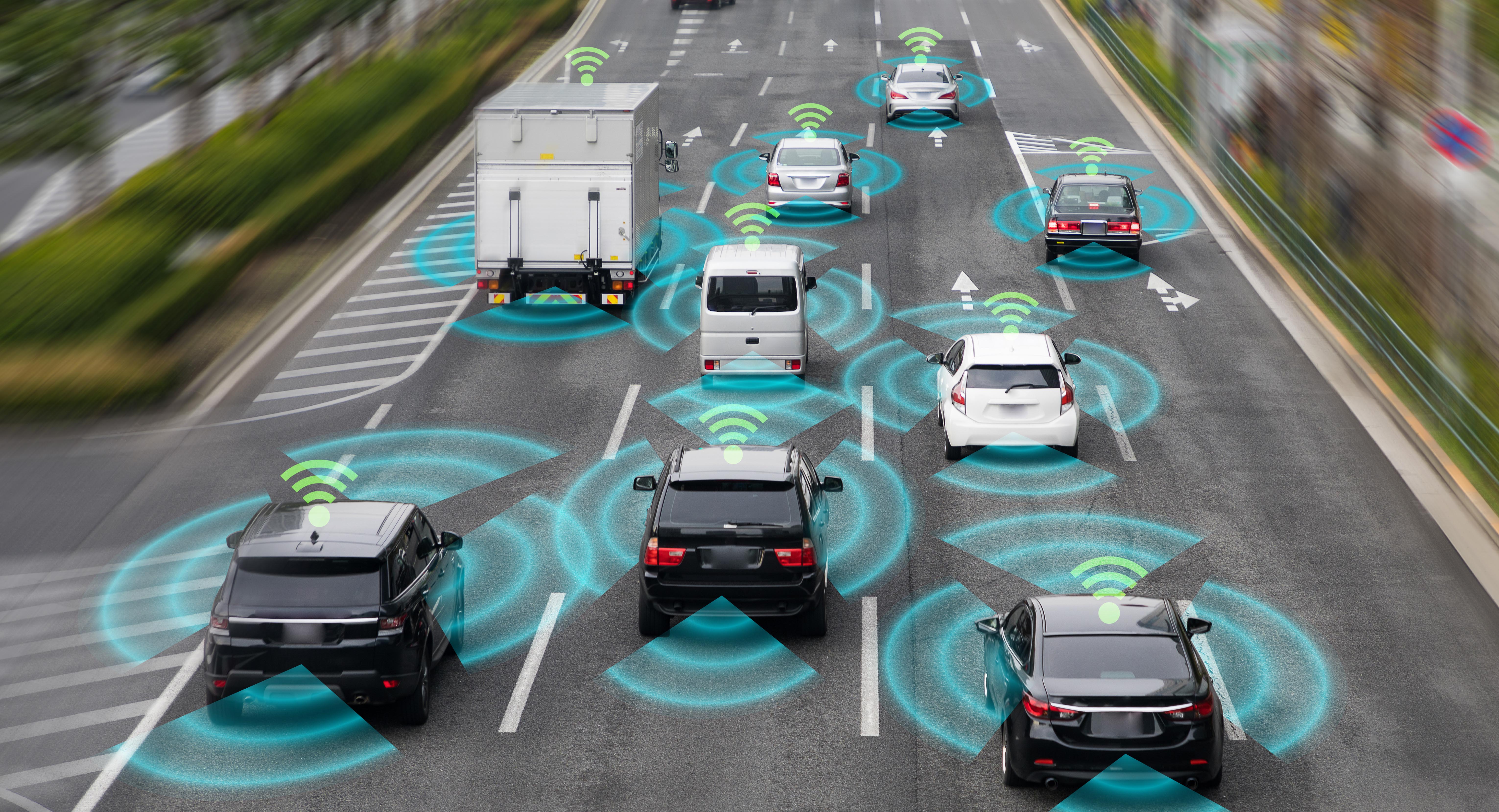

They’ve recalibrated their valuation model after digging through ZTE’s Q4 results and chatting with the company. While the slowdown in 5G investment from China’s telecom giants is real and continuing – and anyone telling you otherwise is selling you a dream – Citi sees a massive opportunity on the horizon: AI.

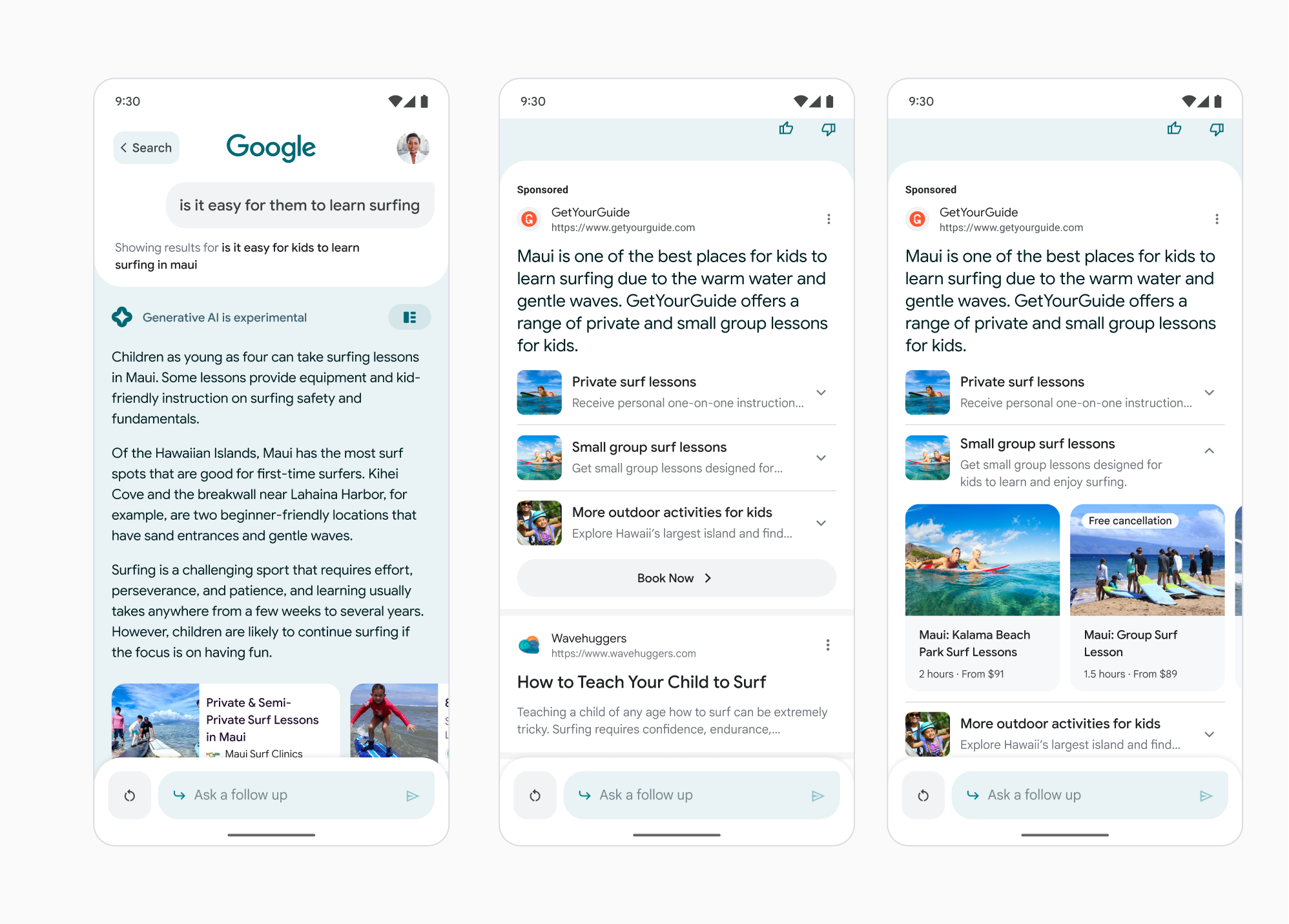

ZTE isn’t just sitting around waiting for 5G to rebound. They’re aggressively shifting gears, transforming into a key provider of the compute infrastructure that will power the AI revolution. Think AI servers, smart switches – the stuff that makes the algorithms tick. This is a big deal. And consumer business is poised to pick up the slack from telecom weakness.

Now, they’ve trimmed profit forecasts for the next couple of years (14-18% – a slight adjustment, not a panic), acknowledging the 5G headwinds. But that adjustment is dwarfed by their growing conviction in ZTE’s AI potential.

Here’s a quick primer on why AI infrastructure is such a game-changer:

AI’s appetite for computing power is insatiable. Every new model, every larger dataset, demands exponentially more processing capabilities.

This fuels demand for specialized hardware like GPUs, but also for the servers and networking equipment that connect it all. ZTE is positioning itself right in the heart of this supply chain.

We’re talking about a fundamental shift in the tech landscape. Companies that can provide the backbone for AI will be the winners.

This isn’t about betting on 5G anymore; it’s about backing a company that’s smartly pivoting to capture the next big wave. Citi clearly agrees, maintaining a ‘Buy’ rating and signaling that we should expect even more AI-driven products and solutions from ZTE in the future. Don’t underestimate this transition – it’s a serious play.