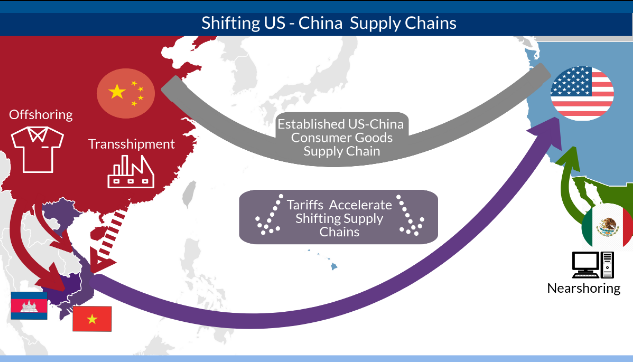

Alright folks, let’s cut through the noise. The market’s been on a rollercoaster, and today’s headlines are significant. First, the big one: a US-China trade agreement is emerging, with both sides agreeing to roll back a hefty 91% of tariffs and pause another 24%. Finally, some common sense prevails, but don’t pop the champagne yet – continued negotiations are key.

Photo source:www.atlanticcouncil.org

China also dropped its ‘New Era National Security’ white paper – a strong signal of intent and an assertion on the global stage. Simultaneously, the iron grip on rare earth exports remains; this is a pressure point we’re watching closely.

Domestically, Beijing is stepping up to support struggling exporters through dedicated roundtables and promises of increased assistance. We need action, not just words.

Now, let’s dive into the individual stock movements.

Here’s a deeper dive into key areas:

Rare Earths & Geopolitics: China’s continued export controls highlight its strategic importance in this sector. It’s wielding its dominance, forcing companies to diversify supply chains, and driving up prices. Think long-term investment implications here.

Trade War De-escalation: While the tariff rollback is positive, it’s crucial to remember the underlying tensions. This is a ‘pause’ not necessarily a ‘peace treaty’. Continual monitoring of negotiations is vital.

Domestic Investment & Innovation: Massive contracts (like China Railway’s 54.74 billion yuan deal) and investments in AI chips (Beijing Lier’s 200 million yuan investment) show a clear focus on technological self-reliance. This is where the growth is.

Individual Stock Highlights:

Tonghua Dongbao: Downplaying Trump’s drug pricing executive order – a smart move, but keep an eye on the unfolding situation.

Kweichow Moutai: No Hong Kong IPO plans…for now. (Don’t hold your breath).

CRRC: Huge contract win – a testament to China’s infrastructure push.

Cooltech Intelligent: AI Agent 2.0 upgrade with Huawei is promising, with 2025 as the target.

Wolong Material: Pursuing a Hong Kong listing – a sign of confidence.

Hansyu Pharmaceutical & Sunshine Nohwa: Exciting developments in GLP-1 drugs and potential acquisitions, respectively. A definite bullish signal.

Yunnan Copper: Trading halt for a potential acquisition – always a nervous time for investors.

Important Lead: Clearmark is planning to offload no more than 1.5% of its holdings in Zhaowei Machinery & Electric. Always pay attention to changes in major shareholder structure.

This is a fluid situation. Stay vigilant, do your research, and don’t let emotion dictate your investment decisions. You can’t afford to be caught sleeping on these shifts!