Friends, colleagues, fellow market watchers – let’s cut to the chase. The latest data from China’s National Bureau of Statistics paints a slightly less grim picture of the housing market, but don’t break out the champagne just yet. We’re seeing a continued narrowing of year-on-year declines in property sales prices across all tiers of cities in March.

Specifically, new home prices in first-tier cities dipped by 2.8% year-on-year, a deceleration from the previous month. Shanghai bucked the trend with a 5.7% increase – a welcome sign, but let’s be real, Shanghai often operates on its own planet. Beijing, Guangzhou, and Shenzhen, however, continued to see declines, albeit at a slower pace.

Second and third-tier cities also showed a stabilization, with declining rates easing. This isn’t a surge in demand, mind you; it’s a strategically softened fall.

Let’s break down what’s happening here. Understanding price metrics is crucial for informed investment decisions.

Firstly, YoY (Year-over-Year) changes compare current prices to the same period last year. It provides a broad perspective, factoring in seasonal fluctuations.

Secondly, month-on-month variations are crucial for gauging current momentum. A narrowing YoY decline suggests a slowing rate of price erosion, not necessarily price increases.

Thirdly, understanding the tiered city categorization (Tier 1, 2, 3) is vital. Tier 1 cities are generally more resilient due to economic strength and population influx.

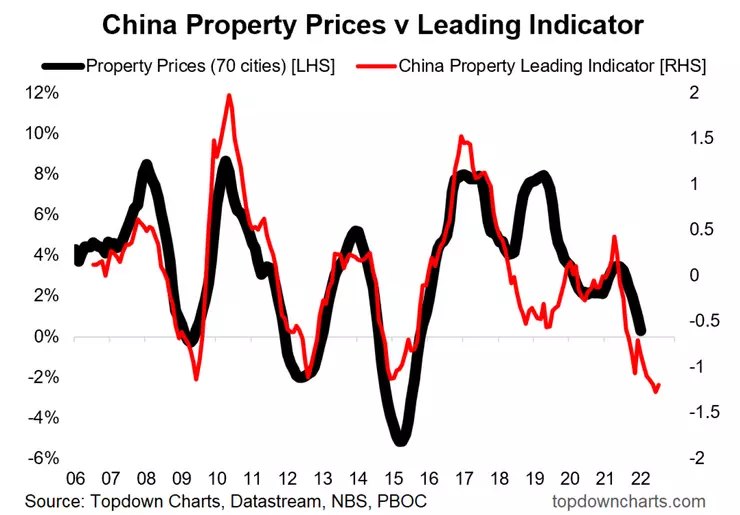

Finally, these price movements are heavily influenced by policy interventions, lending rates, and overall economic sentiment. This data isn’t isolated – it’s a response to a complex web of factors.

Don’t get me wrong – this easing of declines is positive, but we are still in a correction phase. The market isn’t ‘fixed’, just…less broken. Keep a close watch, stay vigilant, and don’t be swayed by overly optimistic headlines.