Let’s be real, folks. For too long, Beijing has tiptoed around the elephant in the room – the property sector. But now, it’s becoming undeniable: a stable housing market is crucial for sparking any meaningful consumer spending. And finally, signals are emerging that officials are waking up to this reality.

According to a recent report from Citic Securities, real estate is now firmly within the government’s broader plan to boost consumption. We’re already seeing a flurry of localized measures, from Guizhou’s renovations to Qingdao’s subsidies, all aimed at halting the price slide.

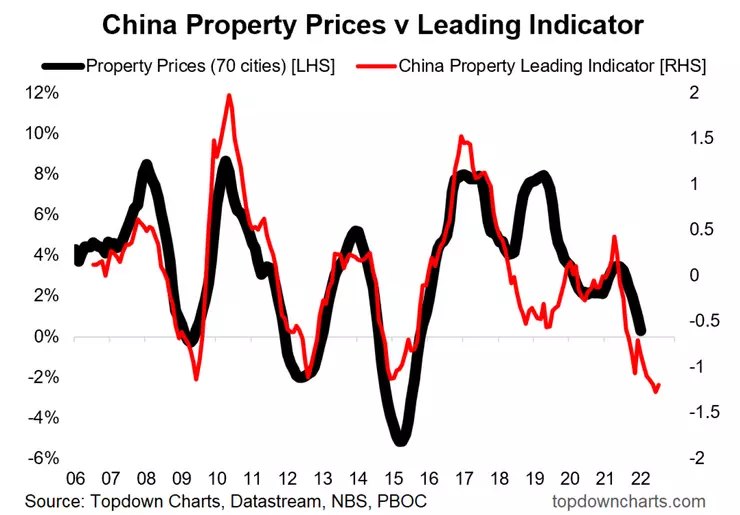

Here’s the bite: March saw price increases in 24 of mainland China’s 70 major cities, a glimmer of hope. However, the overall trend remains downward, amplifying the urgency. The pressure cooker is building.

Now, here’s where it gets interesting. Citic predicts a nationwide stimulus package could drop as early as April or May. This isn’t about bailing out developers; it’s about preventing a deeper economic stall.

Understanding the dynamics at play:

The Chinese property market has long been a pillar of the nation’s economic growth. Recent restrictions and economic headwinds have taken their toll, leading to decreased investment and consumer confidence.

A key economic indicator is new home price trends. While localized gains are positive, a sustained national recovery is essential.

Stimulus efforts can take many forms, including easing mortgage restrictions, lowering down payment requirements, and providing subsidies to both developers and homebuyers.

Looking ahead, developers with strong product innovation and companies holding high-quality assets will be the ones to watch. Don’t underestimate property management and commercial operation services – they’re poised to benefit too.