Friends, buckle up! Gold is teetering on a precipice, staring down the barrel of a potential collapse next week. We’re not talking about a gentle correction here; this is a convergence of risks – a downright perfect storm – threatening to send prices tumbling.

Let’s break down the four horsemen of this impending apocalypse. First, the Federal Reserve meeting. Powell and co. are under immense pressure to maintain a hawkish stance, hinting at continued rate hikes. That’s bullish for the dollar, disastrous for gold.

Then you have the CPI data. A hotter-than-expected print will cement the Fed’s aggressive path, adding further fuel to the fire. Conversely, a cooler print won’t be enough to shift the narrative – inflation is stubborn, and the market knows it.

Trade negotiations are another wild card. Optimism could weaken gold’s safe-haven appeal, while escalation could provide temporary relief, though likely unsustainable.

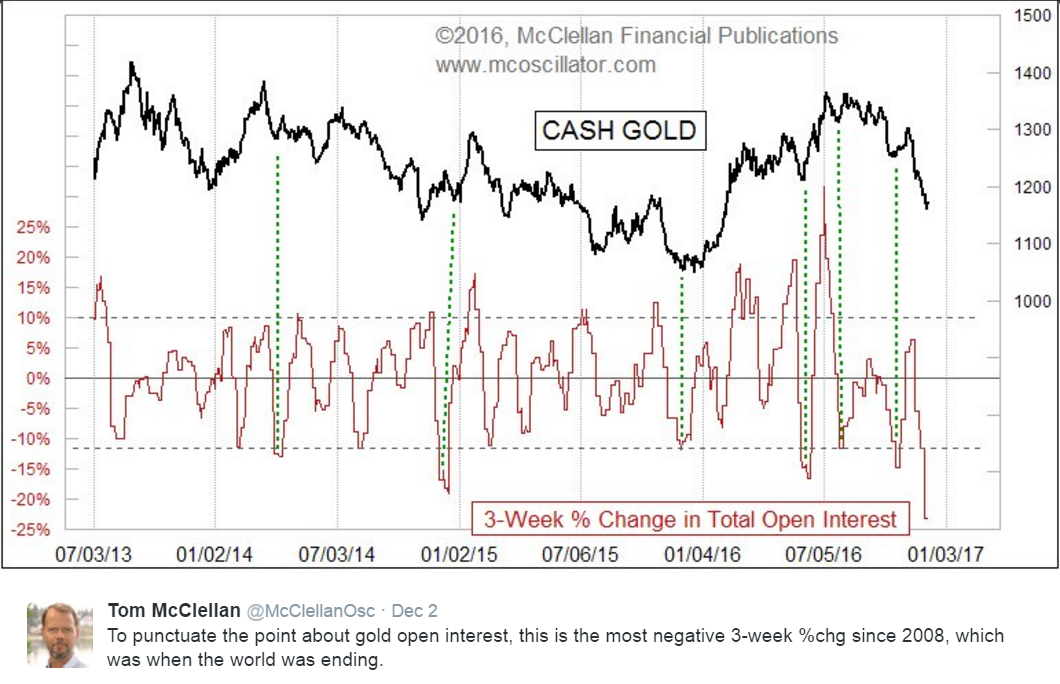

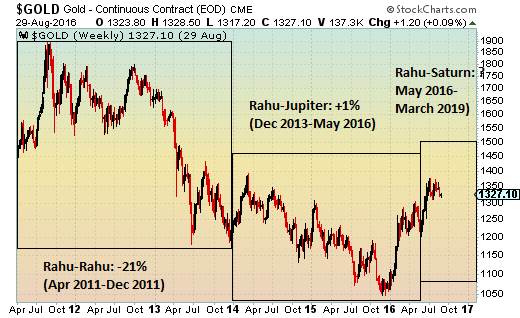

And let’s not forget the technicals! Gold is testing key support levels, and a break below could trigger a cascade of liquidations. The chart is screaming ‘sell,’ but as always, remember charts tell possible futures, not guaranteed ones.

Let’s dive a little deeper into understanding the forces at play:

The Inverse Relationship: Gold and the US dollar typically have an inverse relationship. When the dollar strengthens, gold tends to weaken, and vice versa. Higher interest rates boost the dollar.

Inflation’s Complicated Role: While often seen as an inflation hedge, gold’s performance during inflationary periods isn’t always straightforward. Real interest rates (nominal rates minus inflation) are crucial.

Safe Haven Demand: Geopolitical instability or economic uncertainty often drives investors towards gold as a safe haven. Negotiation outcomes definitely affect market mood.

Technical Analysis Basics: Support and resistance levels represent price points where buying or selling pressure is expected to emerge. Breaking these levels can signal a significant trend change.

This isn’t financial advice, folks. It’s a hard look at the reality staring us in the face. Protect your capital, be vigilant, and prepare for volatility. The coming week will be a defining moment for the yellow metal. Don’t get caught on the wrong side of this trade.