Hold onto your hats, folks! Goldman Sachs just threw a massive vote of confidence into the market, jacking up its year-end 2025 target for the S&P 500 from 5900 to a whopping 6100! According to DeepTechFlow, this isn’t just a minor tweak – it’s a significant shift in outlook and signals they think the bulls have way more gas in the tank than previously expected.

Photo source:www.instagram.com

Honestly, this feels like a gut punch to all the doom and gloom merchants out there, the perma-bears who’ve been predicting a crash for… well, forever. It’s time to reassess!

But why the sudden optimism? Let’s get into some of the underlying fundamentals driving this bullish call:

Firstly, corporate earnings are proving resilient. Companies are managing to navigate inflation and supply chain hiccups far better than anticipated.

Secondly, the US economy, despite all the hand-wringing, is showing surprising strength. While the Fed’s interest rate policy has been a tightrope walk, the economy is handling it, avoiding a hard landing (so far).

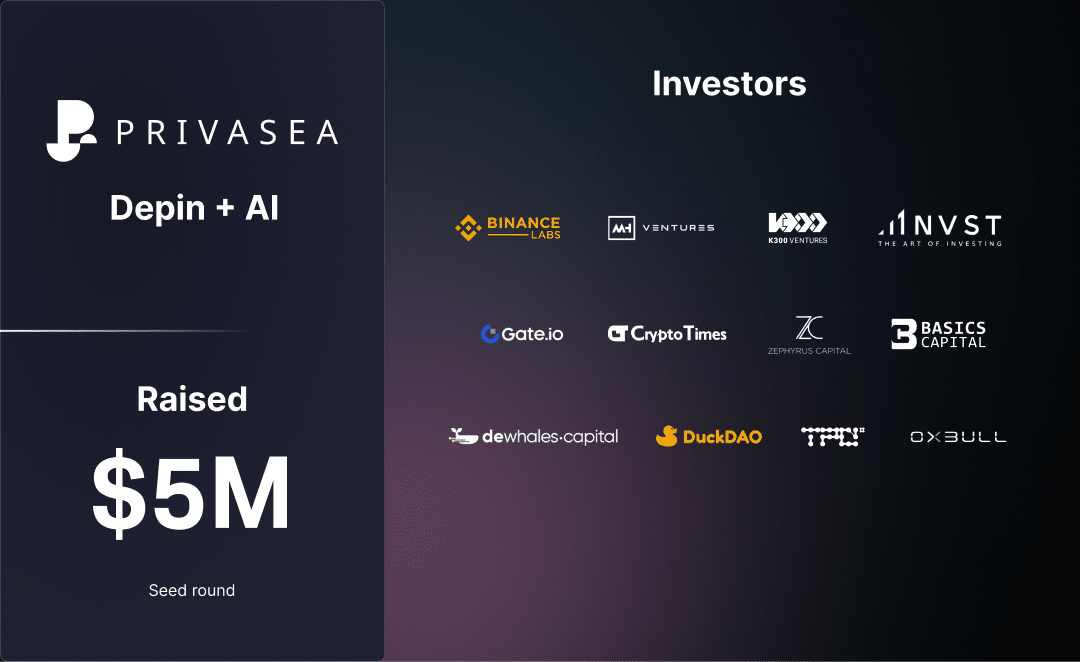

Finally, it’s about sentiment. Investors are slowly, but surely, regaining confidence. This includes acknowledging the artificial intelligence (AI) boom as a genuine catalyst for growth.

Now, does this mean we’re guaranteed a smooth ride to 6100? Absolutely not. Volatility is still lurking around every corner. But Goldman’s move is a powerful indicator. They are betting big on continued growth, and that’s something we need to pay attention to. Buckle up and enjoy the ride, or get left behind!