Alright folks, buckle up! We saw gold surge last week – COMEX jumped 2.52% to $2332.10/oz, and Shanghai Gold ticked up 0.77% to 788.42 yuan/gram. But don’t get too comfy, because the narrative is shifting and the smart money might be about to move.

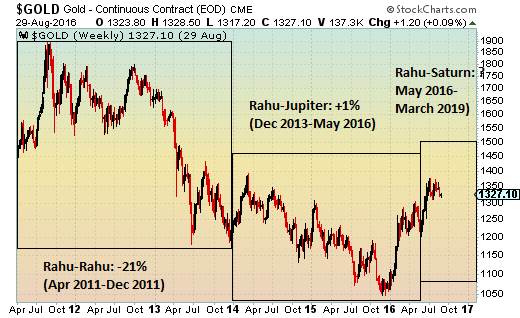

Photo source:www.modernvedicastrology.com

The biggest news? A genuine breakthrough in US-China trade talks in Switzerland! They’ve agreed to a dedicated dialogue – finally! – with clear leadership on both sides, paving the way for a joint statement on May 12th. This isn’t just talk; it’s a potential gamechanger for global risk appetite.

Let’s talk about the Fed. Harker emphatically stated that broad asset purchases are off the table for their current review. Essentially, quantitative easing as we knew it isn’t coming back anytime soon.

Here’s where it gets really interesting. The CME FedWatch tool shows the market is now pricing in an 82.7% chance of no rate cut in June, with just a 17.3% probability of a 25 bps cut. Looking ahead to July, the odds shift – 40.8% hold, 50.7% for a 25 bps cut, and a measly 8.7% for 50 bps. That’s a serious slowdown in easing expectations.

Knowledge Point: Understanding the Interplay of Trade, Rates and Gold

Trade tensions tend to drive investors towards safe-haven assets like gold. Reduced uncertainty then lowers demand.

Lower interest rates generally weaken the dollar, making gold more attractive. A hawkish Fed (less inclined to cut rates) strengthens the dollar, potentially pressuring gold.

The yield curve, often an indicator of economic outlook, plays a role. Flattening or inverting curves can signal recession risks and boost gold demand.

Investor sentiment, shaped by economic data and geopolitical events, directly influences gold’s price fluctuations.

Bottom line? This trade progress and the Fed’s more cautious stance point to a potential exodus of risk-off flows from gold in the short term. I’m not saying sell everything, but be prepared for a potential pullback. Keep a close eye on that joint statement on May 12th; it could solidify this trend. Don’t get caught flat-footed!