Okay, folks, hold onto your hats! The latest Producer Price Index (PPI) data just dropped, and it’s HUGE. We’re talking a year-over-year increase of just 2.4% for April – the lowest we’ve seen since September of last year! This isn’t just a dip, it’s a third consecutive month of declines. Seriously, this is getting interesting.

But wait, there’s more! The month-over-month PPI actually fell by 0.5%. That’s right, negative 0.5%! This is the biggest monthly drop since the freaking early days of the pandemic – April 2020 to be exact. And it absolutely blows away what the market was expecting (a measly 0.2% increase).

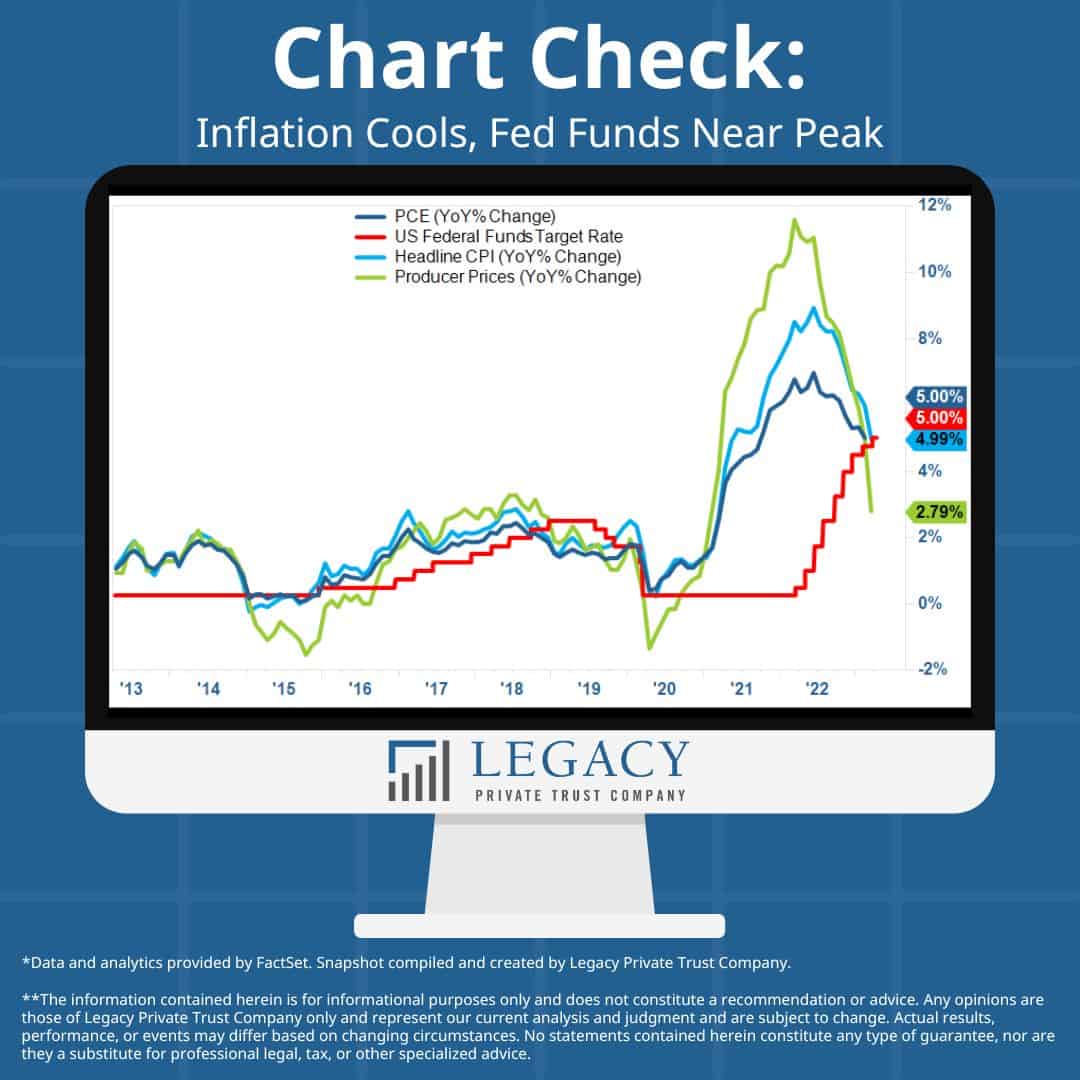

What does this mean? Well, simply put, inflation is cooling down. Prices at the wholesale level are easing, meaning less pressure on businesses. This could finally give the Federal Reserve some breathing room.

Let’s dive a little deeper into what PPI actually is.

PPI, or the Producer Price Index, is a key economic indicator measuring the average change over time in the selling prices received by domestic producers for their output. It’s essentially a barometer of inflation at the wholesale level.

Unlike the Consumer Price Index (CPI), which tracks prices paid by consumers, PPI focuses on what producers are charging. A decline in PPI usually foreshadows a moderation in CPI down the line, impacting goods and services we all buy.

It’s worth remembering that this doesn’t mean everything’s sunshine and roses. We still have a long way to go to get inflation back to the Fed’s 2% target. But this is definitely a welcome sign.

So, is the Fed about to start cutting interest rates? Don’t hold your breath for an immediate change, but these numbers definitely put them in a tighter spot. They can’t ignore this data. This is getting spicy!