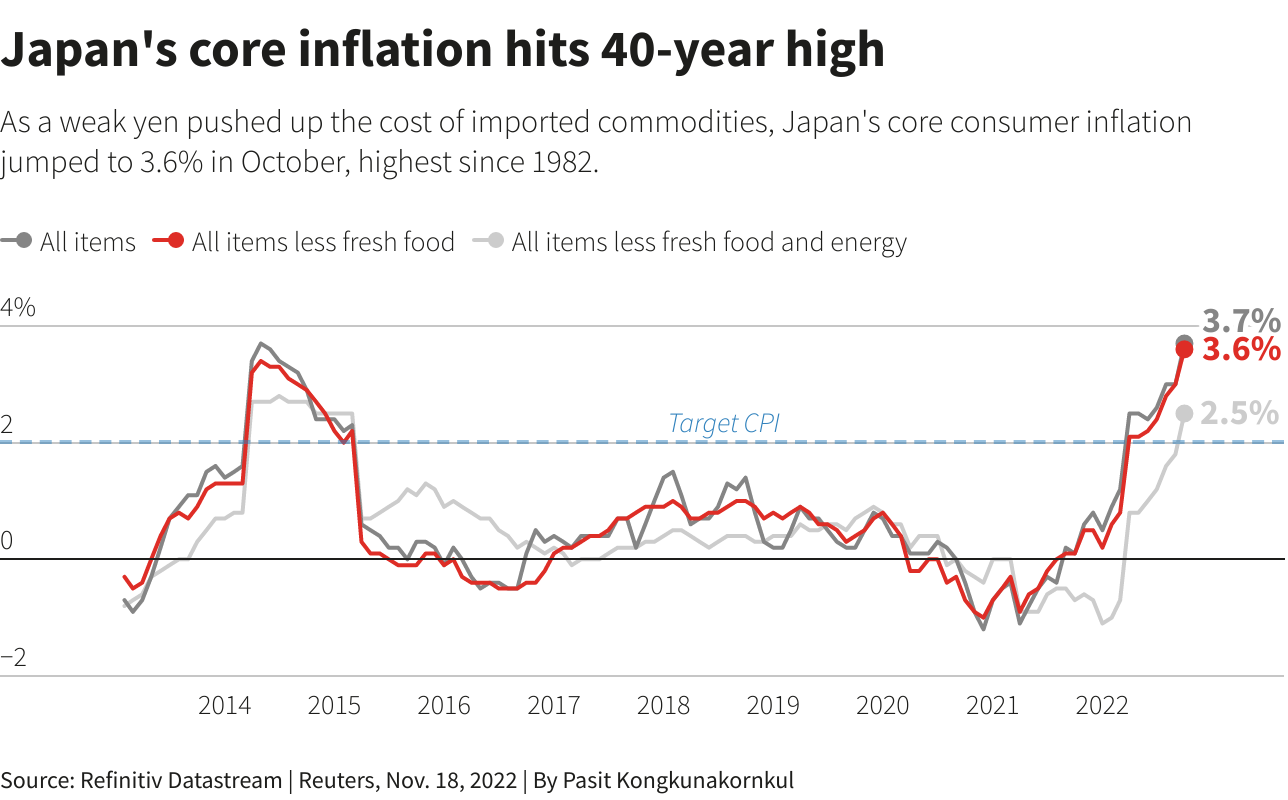

Friends, buckle up. Japan’s core inflation just hit 3.5% in April – the highest in over two years! That’s right, the pressure is mounting on the Bank of Japan (BOJ) to finally consider raising interest rates. This isn’t some minor blip; it’s a clear signal that price pressures are tenacious and not fading away.

Let’s break down what’s really happening. This core CPI figure, excluding fresh food but including those pesky petroleum products, is a critical indicator. It’s exceeding the BOJ’s 2% target for over three years – a frankly embarrassing overshot considering their long-held deflationary concerns.

But it’s not just domestic forces at play. We’re seeing the ripple effects of potential tariffs from former President Trump. A stronger US dollar, driven by these threats, is adding another layer of complexity for the Japanese economy. It’s a treacherous tightrope walk for the BOJ.

Here’s a little deeper dive for those who want to understand the nuances:

Core inflation measures price changes for goods and services excluding volatile food items like vegetables. This provides a clearer view of underlying inflationary trends.

The BOJ has maintained an ultra-loose monetary policy for years, hoping to stimulate economic growth. But persistent inflation throws a wrench into that plan.

A sustained rise in core inflation could signal stronger domestic demand, finally breaking Japan’s long-standing deflationary cycle.

However, external factors, such as currency fluctuations and global trade tensions, continue to pose significant risks to Japan’s economic outlook. The BOJ needs to tread very carefully.

This isn’t just about numbers, folks. It’s about the future of Japanese monetary policy and the potential ramifications for global markets. I’ll be keeping a very close eye on this one – and you should too.