Alright folks, let’s talk gold. This morning, April 7th, 2025, Shanghai gold opened at a cool 723.52 yuan per gram. Now, hold your horses, because that’s a significant 5.89 yuan above the international spot price of 717.63 yuan per gram. What the hell is going on here?

This isn’t some rounding error. This is a premium, a tangible representation of demand. And let me tell you, it’s catching my eye. It suggests serious buying pressure in the Chinese market, which, as we all know, is a HUGE player in the global gold landscape.

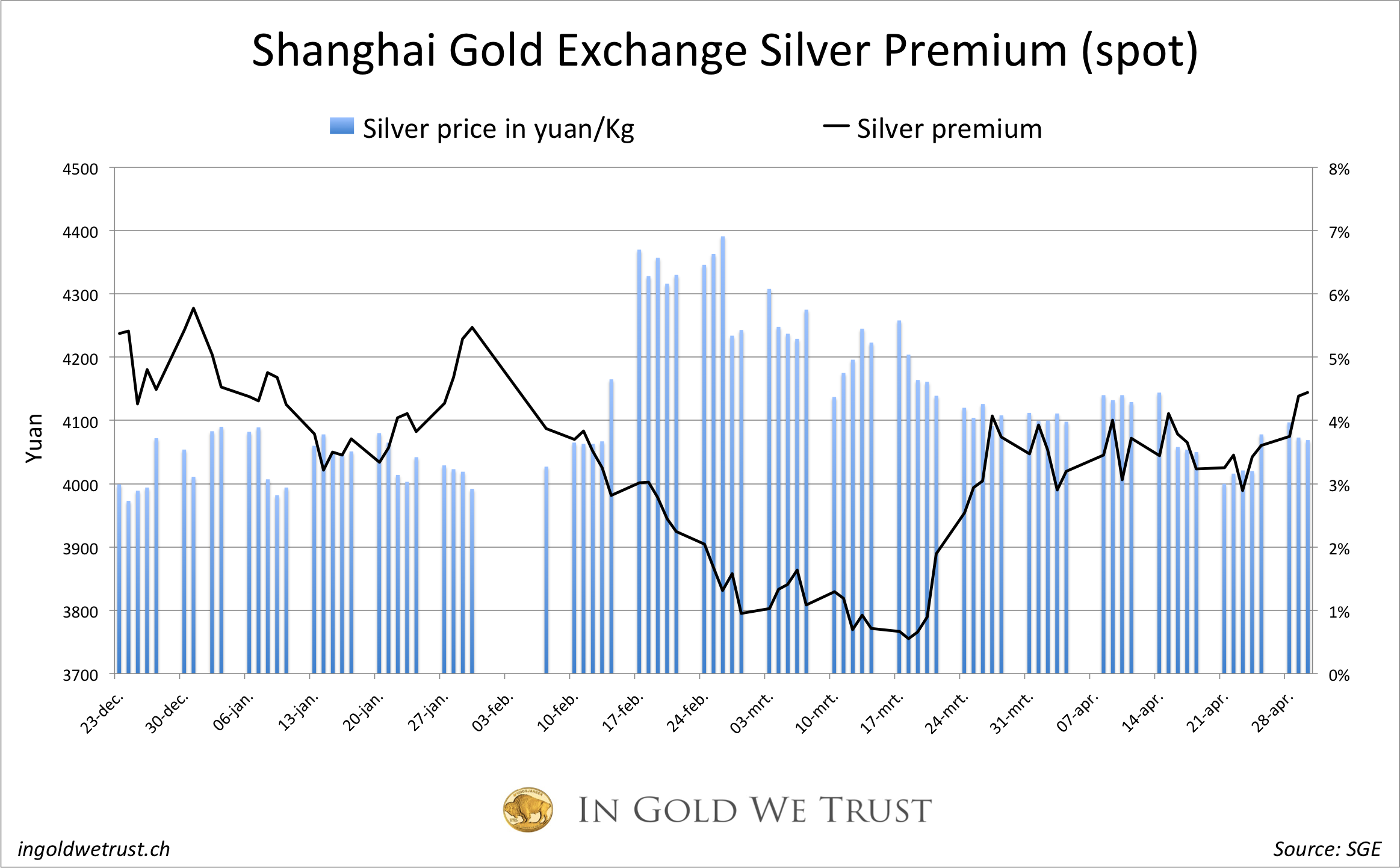

Let’s break down why this premium matters. When local prices persistently trade above international benchmarks, it points to strong domestic demand that isn’t being fully met by imports. Think about it – people are willing to pay more to get their hands on the shiny stuff.

Understanding Gold Premiums – A Quick Dive:

Gold premiums are the difference between the spot price (the current market price for immediate delivery) and the price buyers are actually paying. It’s a reflection of local market forces.

Several factors can drive these premiums: import duties, logistical costs, and, crucially, demand. High demand and constrained supply will push premiums up.

Geopolitical risks often trigger increased physical gold demand as a safe haven asset. Think wars, economic instability, or just plain old fear.

China, particularly during festive seasons or economic uncertainty, demonstrates a strong affinity for physical gold. This cultural and investment preference influences premiums.

Now, some folks will say it’s just a temporary blip, maybe some seasonal buying for upcoming holidays. Maybe. But I’m not convinced. To me, this smells like a deeper bullish signal. We need to keep a close watch on this premium over the coming days. Is it sustainable? Will it widen? If it does, buckle up, because this could be the start of something big. Don’t sleep on this, seriously. This is where the smart money is paying attention.