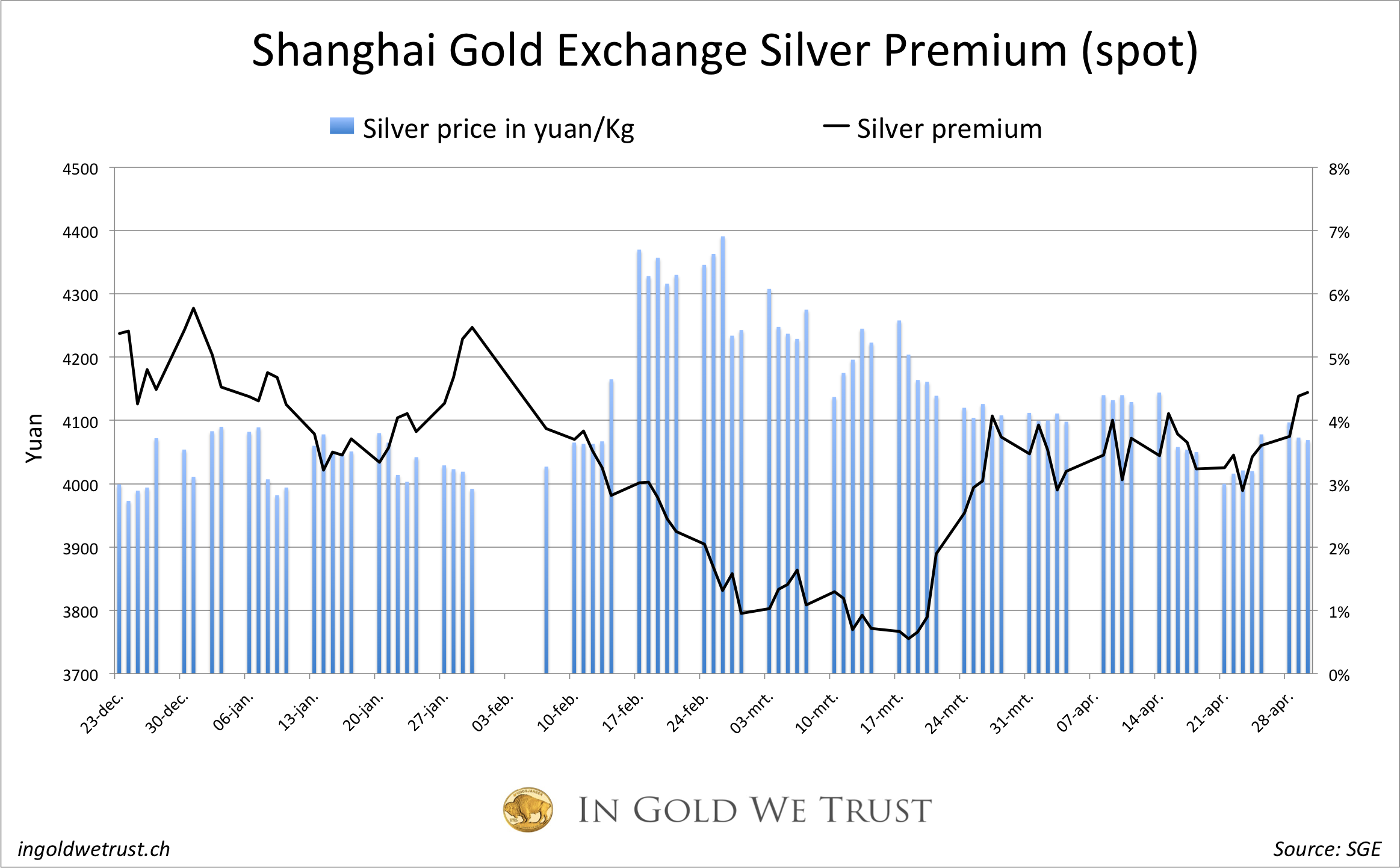

Friends, buckle up! The Shanghai Gold Exchange (SGE) opened sharply lower this Monday, April 28th. Gold T+D futures plummeted 0.44% to 787.01 yuan/gram in early trading, while silver T+D took an even bigger hit, dropping 1.06% to 8192.0 yuan/kilogram.

Photo source:www.bullionstar.com

This isn’t just noise, folks. It’s a clear signal that market sentiment is shifting. We’re seeing a pullback likely fueled by a combination of factors, including strengthening dollar and profit-taking after recent gains. Don’t get caught flat-footed.

Let’s talk gold a bit. Gold, often considered a ‘safe haven’, reacts inversely to economic strength. A robust dollar typically puts downward pressure on gold prices.

Silver, with its industrial applications, is also susceptible to broader economic trends. If economic forecasts are revised downwards, silver can suffer alongside precious metals like gold.

Understanding the T+D mechanism is key. ‘T+D’ – Trade plus Delivery – is a unique feature of the SGE. It means investors can trade today and take physical delivery of the metal tomorrow!

This impacts pricing dynamics significantly, making Shanghai a vital barometer for physical demand, especially in China, the world’s largest gold consumer. Stay vigilant, adjust your strategies, and keep a close eye on global economic indicators. This dip might present an opportunity… but proceed with caution!