Hold onto your hats, silver bugs! The world’s largest silver ETF, iShares Silver Trust (SLV), just experienced a notable outflow of 4.25 tonnes yesterday. That brings its total holdings down to 13,956.01 tonnes. Let’s be clear: this isn’t just a number; it’s a potential warning sign.

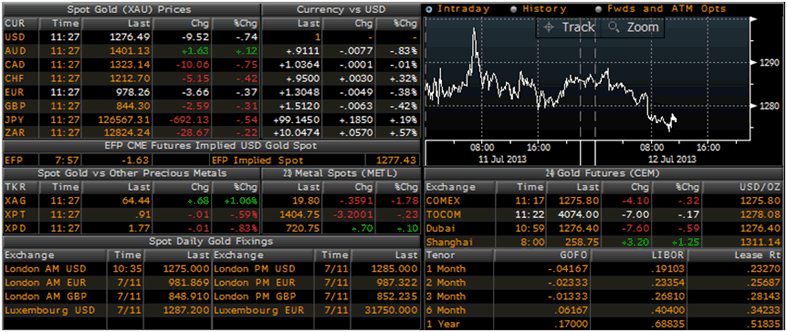

Photo source:forextraininggroup.com

These outflows suggest waning investor confidence in silver, at least in the short term. People are hitting the ‘sell’ button, and that’s never a comfortable sight. Is this a temporary correction, or the beginning of a more substantial pullback? That’s the million-dollar (or should I say, silver-dollar?) question.

Understanding Silver ETFs and Holdings:

Silver ETFs like SLV hold physical silver bullion to back their shares. When investors buy shares, the ETF buys silver; when they sell, it sells silver. So, tracking holdings provides insight into investor sentiment.

The Significance of ETF Outflows:

Large outflows can put downward pressure on silver prices. Reduced demand from a major buyer like SLV impacts the broader market. It’s crucial to watch these patterns closely.

Factors Influencing Silver Prices:

Beyond ETF movements, silver is sensitive to industrial demand, inflation expectations, and currency fluctuations. Keep a close eye on these factors alongside ETF data for a comprehensive outlook.

Don’t panic sell, but do pay attention. This move warrants further investigation and a reassessment of your own silver strategy. The silver market is notoriously volatile, and understanding the nuances is key to navigating it successfully. I’ll be digging deeper into the potential drivers behind this outflow – stay tuned!