Friends, followers, and fellow market watchers – pay attention! We’re seeing a significant move in the Shanghai Gold Exchange this morning. Gold futures (T+D) just leaped 0.86% to 799.0 yuan/gram in early trading today, April 25th (Friday). Silver isn’t lagging behind either, climbing 0.33% to 8310.0 yuan/kilogram.

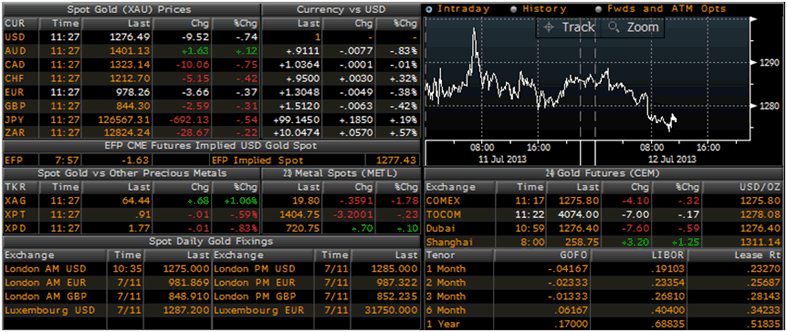

Photo source:www.marketoracle.co.uk

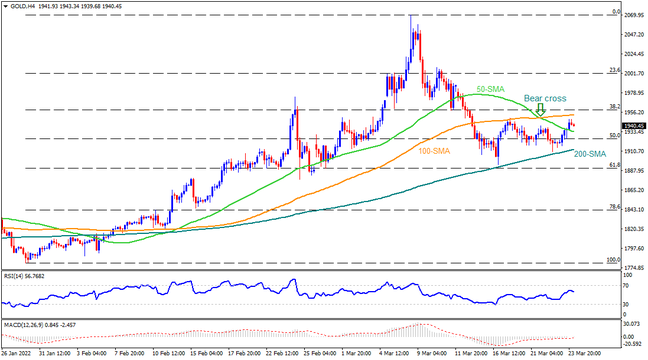

This isn’t just noise; it’s a clear signal. The market is reacting to… well, everything! Geopolitical tensions, persistent inflation fears, and a weakening dollar are all contributing to this rally. It’s the classic ‘flight to safety’ play, and gold and silver are the ultimate safe havens.

Let’s quickly dive into why these metals are so crucial during times like these:

Historically, gold has maintained its value, even during economic downturns. It’s seen as a store of wealth when paper currencies falter.

Silver, while more volatile than gold, boasts both safe-haven appeal and strong industrial demand. Growing usage in tech adds another layer of potential.

These price movements are indicative of broader anxieties in the financial system. Investors aren’t confident in traditional assets, and they’re seeking alternatives.

This isn’t a time for complacency. Keep a close eye on these markets. Are we seeing the start of a sustained rally? Or just a temporary bounce? Only time will tell, but ignoring this now could be a costly mistake. Don’t just HODL, understand why you’re holding!