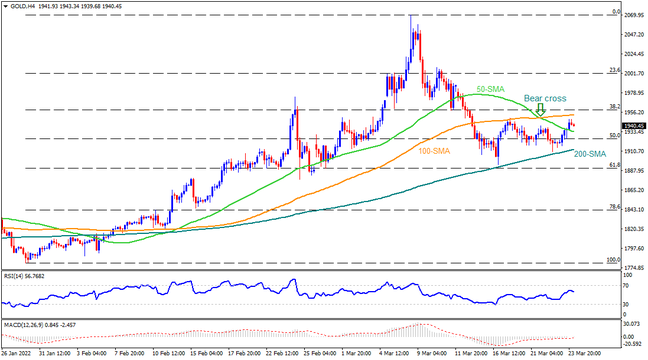

Friends, the market is a cauldron of conflicting forces right now, and gold, as a traditional safe haven, is caught in the crossfire! We’re seeing a perfect storm of geopolitical tensions, escalating trade wars, and unpredictable economic data—making predicting gold’s next move feel like reading tea leaves.

Forget the noise, let’s get real. This isn’t about simple bullish or bearish narratives; it’s about understanding the dynamic interplay of factors driving price action. We’re facing potential tariff escalations that could send shockwaves through global markets.

Did you know that gold historically thrives during periods of uncertainty? It’s often seen as a hedge against inflation and currency devaluation.

However, rising interest rates can sometimes dampen gold’s appeal, as investors gravitate towards yield-bearing assets. It’s a delicate balance!

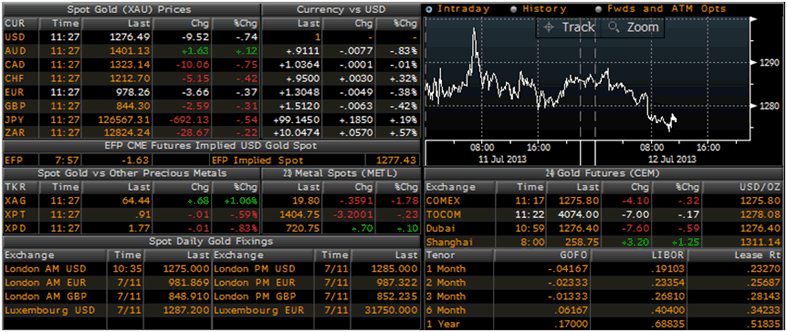

Furthermore, central bank policies play a crucial role. Global central banks’ gold reserves and their monetary policies impact the supply and demand dynamics.

Understanding these nuances – the pull of safe haven demand versus the weight of macroeconomic forces – is key to successful trading. Don’t just follow the herd; analyze the fundamentals!

I’m seeing opportunities within this volatility, but you need to be prepared. You need a clear strategy, disciplined risk management, and a solid understanding of the futures market.

That’s why I’m opening up a limited-time, free futures trading bootcamp! We’ll break down the complexities, giving you the tools you need to navigate this turbulence and potentially profit.

But listen carefully: spots are extremely limited – only 50 places remain! Don’t miss out. Click here to join the group now and let’s trade this chaos together! Don’t hesitate, this offer won’t last.