Alright, folks, let’s cut to the chase. The latest margin debt figures are in, and they’re telling a story – a story of growing investor hesitancy. As of yesterday, April 24th, Shanghai Stock Exchange margin debt clocked in at 913.26 billion yuan, down 15.7 billion yuan from the previous session. Shenzhen wasn’t far behind, shedding 13.7 billion yuan to reach 878.30 billion yuan.

Combined, both exchanges saw a decrease of 29.4 billion yuan, bringing the total to 1791.56 billion yuan. This isn’t a massive drop, but it’s a noticeable pullback. What does it mean? Well, it suggests investors are becoming a little more risk-averse and are reducing their reliance on borrowed money to fuel their trades.

Let’s unpack this a bit. Margin trading, for those new to the game, allows investors to borrow funds from their brokers to increase their buying power. It’s a double-edged sword – potential for higher gains, but also amplified losses.

Decreasing margin debt can indicate several things. Firstly, investors may be scaling back their positions in anticipation of a potential market correction. Secondly, it could reflect a lack of confidence in future market rallies. Or, it might simply be profit-taking after recent gains.

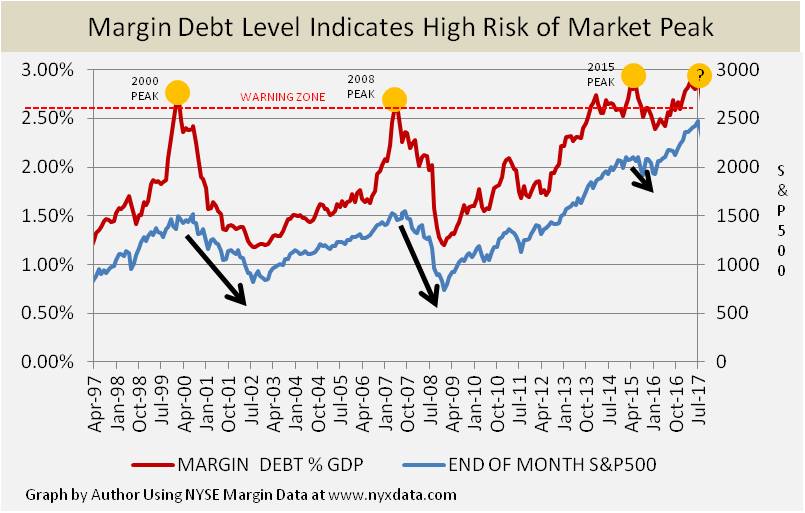

Understand the significance of margin debt: it’s a liquidity indicator. When it rises, it suggests bullish sentiment and potential momentum. When it falls, it often foreshadows consolidation or even a downturn. Keep a close eye on this figure, because it’s a critical piece of the puzzle when assessing market health.

Essentially, this decrease in margin debt isn’t a flashing red alarm, but it’s a yellow caution light. A slowdown in borrowing suggests the easy money may be drying up, and investors are thinking twice before doubling down.