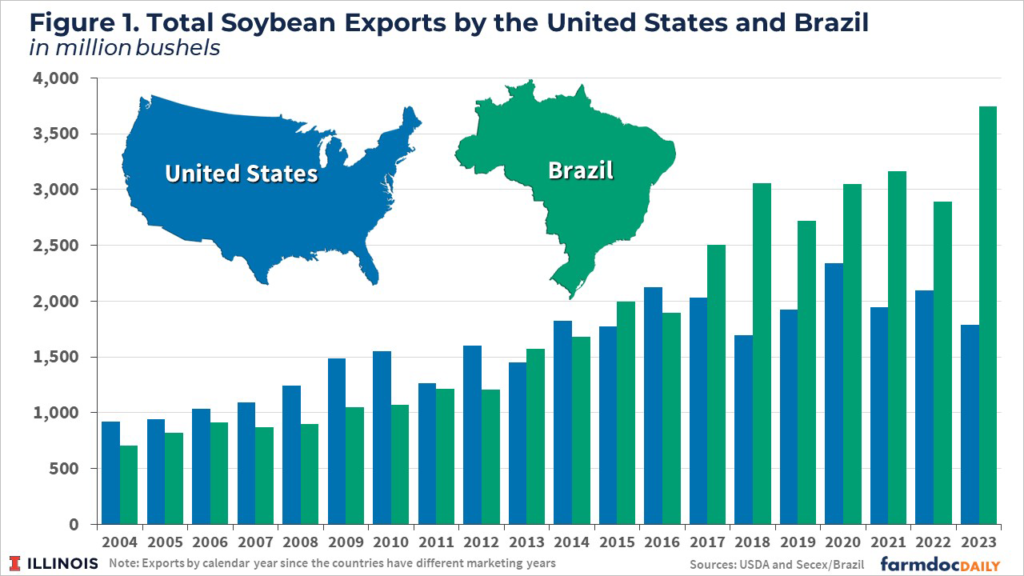

Alright, folks, let’s talk soybeans. The market’s been buzzing, and the whispers are getting louder: China, the world’s biggest soybean importer, is increasingly turning to Brazil. This isn’t just a shift in trade; it’s a seismic event with major implications for US soybean exports, and frankly, for the bullish bets many have placed on them.

Photo source:farmdocdaily.illinois.edu

Why the change? Brazil’s harvest is looking robust, and frankly, pricing is becoming increasingly competitive. But this isn’t solely about economics. Geopolitical factors and ongoing trade dynamics are absolutely playing a role. Let’s not sugarcoat it; US soybeans are facing a serious headwind.

Now, where does that leave the bulls? Why are traders still stubbornly clinging to the idea of higher prices? Well, the narrative is tight global supplies and continued demand. But relying solely on that story is…naive, at best.

Let’s drill down a bit into the soybean story and understand where we are.

Firstly, soybeans are a crucial protein source for livestock feed, especially in China’s massive pork industry. China’s demand, despite economic headwinds, remains incredibly strong.

Secondly, weather patterns are always a critical factor. The South American growing season has benefited from favorable conditions, boosting production significantly. Meanwhile, the US is historically prone to weather-related disruptions.

Thirdly, logistical advantages – Brazil is simply closer to China, reducing transportation costs and time. This is a killer in a competitive market.

Lastly, and perhaps most importantly, diversification. China isn’t putting all its eggs in the US basket anymore. They’re actively building alternative supply chains, and that’s a long-term trend. We need to be realistic about this, people. The market doesn’t care about your convictions, it cares about supply and demand. The current dynamic strongly suggests a reassessment is in order.