Friends, let’s talk about what’s really happening in Shanghai’s property market. Yesterday, the highly anticipated Feiyun Yuefu in Pudong, a project with asking prices exceeding 100,000 yuan per square meter, completely sold out all 228 units on its launch day. ‘Sold-out’, or ‘日光’ as the Chinese market calls it, is quickly becoming a common headline.

This isn’t an isolated incident. Before Feiyun Yuefu, we saw SPDB Lianyuan and Xiamen OCT Riverside Garden achieve the same instant sell-out status in April alone. That’s three in one month!

Let’s break down the numbers. Feiyun Yuefu offered apartments ranging from 120 to 140 square meters, priced around 107,200 yuan per square meter. This is significant, folks – this isn’t your average buyer we’re talking about.

Understanding the ‘Sun Disk’ Phenomenon (日光盘):

The ‘Sun Disk’ phenomenon, meaning a complete sell-out on launch day, is a key indicator of market fervor. It often signals strong demand, limited supply, and frequently, speculative investment.

Shanghai is leading the charge. In Q1 2024 alone, a staggering 10 projects achieved this status, far outpacing Beijing (1) and Shenzhen (2). This highlights Shanghai’s robust economy and persistent demand for premium real estate.

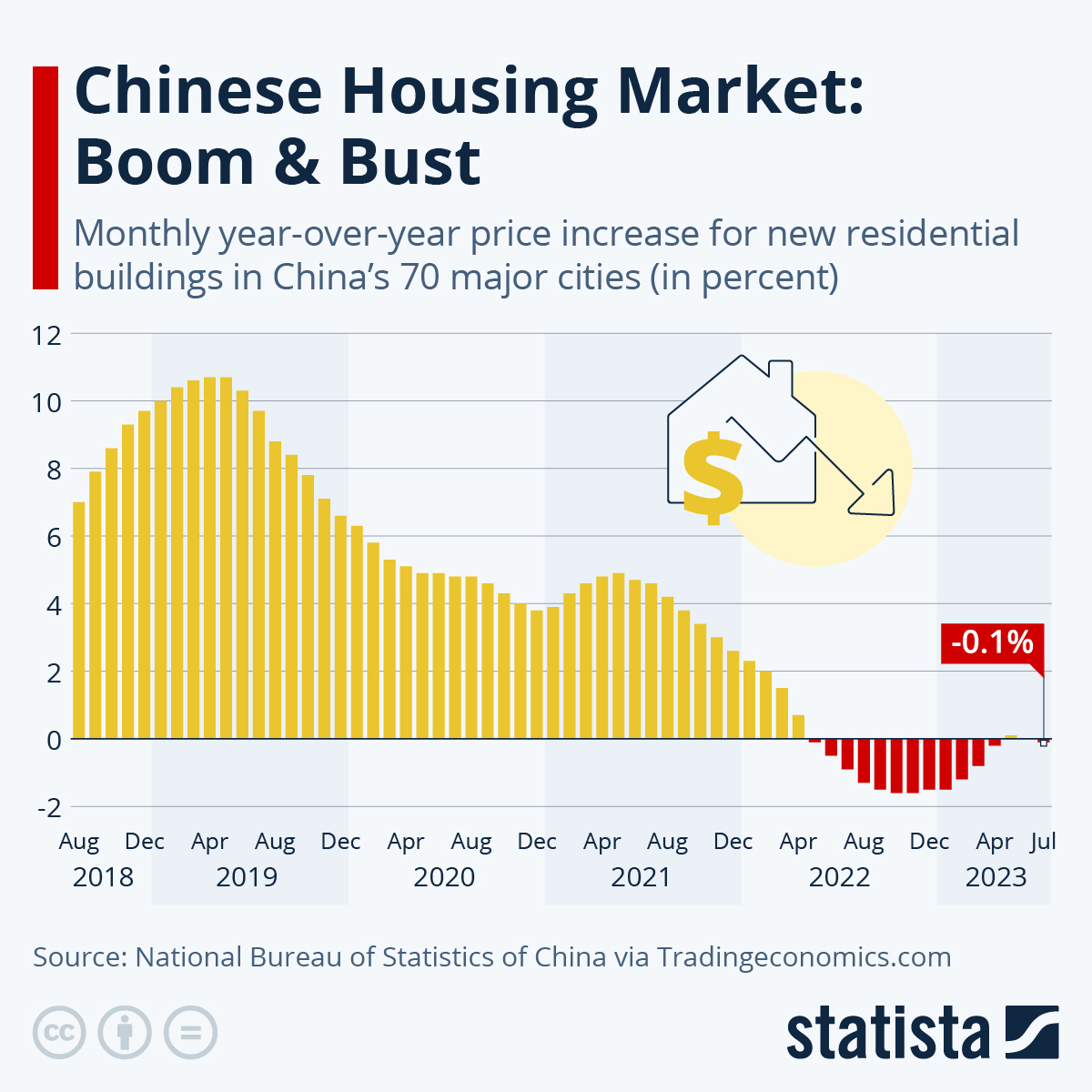

But here’s where it gets interesting. Is this genuine organic demand, or are we seeing a surge in speculation fueled by expectations of further price increases? The elephant in the room is the potential for a bubble. These rapid sell-offs, while impressive, should be viewed with a healthy dose of skepticism. Is this sustainable? I remain cautiously optimistic, but also deeply aware of the risks. We need to look beyond the headlines and analyze the underlying fundamentals.