Alright, folks, let’s talk about China’s property market – a sector that’s been stuck in the mud for far too long. A new research report from Huatai Securities is signaling a potentially significant shift. They’re pointing to a gradually opening window for incremental policy support, and frankly, it’s about time.

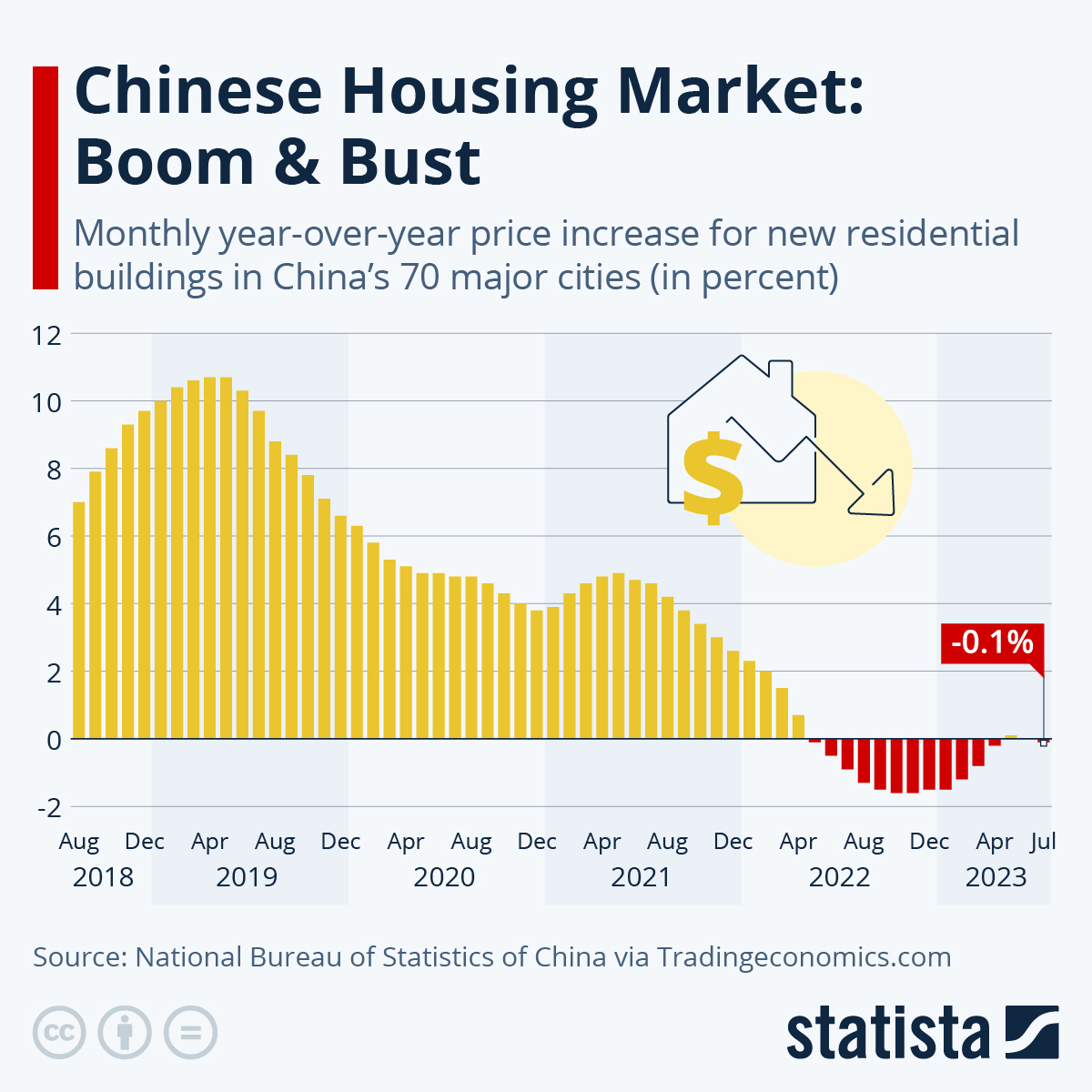

We’ve been hearing rumblings of more proactive fiscal policy and a generally more supportive macroeconomic environment. This isn’t just wishful thinking; it’s a response to the pressures building in the sector. We’ve seen developers struggling, sales slumping, and frankly, a lot of anxiety in the market.

Here’s the kicker: Huatai believes Tier 1 cities – Beijing, Shanghai, Shenzhen, and Guangzhou – have the most policy leeway. This means we could see targeted measures designed to stabilize and revitalize these key markets. Ultimately, this makes me optimistic about a potential rebound, and more importantly, about identifying the right investment opportunities.

Understanding the Policy Window – A Quick Dive:

Policy windows represent a limited timeframe when political conditions are favorable for enacting new policy changes. These windows don’t stay open forever and require a convergence of factors, like economic pressure and political will.

In China’s case, the pressure stems from slowing growth in the property sector, a crucial component of the economy. The ‘political will’ seems to be emerging with the government’s increasing emphasis on stability and growth.

Incremental policy doesn’t mean a dramatic overhaul. Instead, expect targeted measures, such as easing mortgage restrictions, offering subsidies to homebuyers, or relaxing developer financing rules. The key is watching how these policies translate into tangible effects on the ground.

Essentially, keep a close watch on the implementation pace! Now is the time for careful analysis and strategic positioning. Don’t fall for the hype, but don’t ignore the potential here. This isn’t a guaranteed recovery, but it’s the first real sign of life we’ve seen in a while.