Let’s be blunt: the Republican tax bill that just passed the House is a masterclass in wealth redistribution – upwards. While they’re touting this as a boon for the economy, the real beneficiaries are those already swimming in cash. This isn’t about stimulating growth; it’s about solidifying the power of the elite.

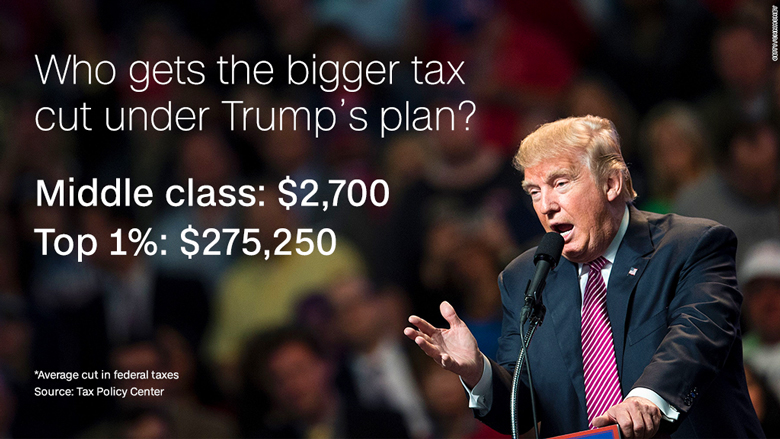

The numbers speak for themselves. The lion’s share of tax breaks – think cuts for business owners, investors, and those lucky enough to live in high-tax states – will land squarely in the pockets of the wealthiest Americans. Meanwhile, those struggling to make ends meet? They’re staring down the barrel of reduced social safety nets.

Here’s a breakdown of what’s actually happening:

This bill fundamentally shifts the tax burden. It favors capital gains and corporate interests, while neglecting the needs of working families. It’s a short-sighted gamble with long-term consequences for economic equality.

The CBO, a non-partisan arbiter of fiscal reality, projects that the bottom 10% will see their incomes fall by 2% in 2027 and a devastating 4% by 2033. Conversely, the top 10%? A cool 4% income boost in 2027, and 2% in 2033. Does that sound like equitable growth to you?

Let’s dive deeper into the implications of such a drastically unequal distribution of wealth. It’s not just about numbers; it’s about access to opportunities.

Tax policy profoundly influences income inequality. Lower taxes on the wealthy combined with cuts to social programs create a vicious cycle.

Capital gains tax rates are often lower than income tax rates. This disproportionately benefits those who derive most of their income from investments.

Reduced social safety nets limit opportunities for lower-income individuals to improve their economic standing.

This bill is a stark reminder that tax policy isn’t neutral. It’s a reflection of priorities, and right now, the priority is clear: wealth consolidation. Don’t let anyone tell you otherwise. We need to demand better, a system where prosperity is shared, not hoarded.