Hold onto your hats, folks, because the bond market is sending a chilling signal! The 2-year US Treasury yield has continued its descent, hitting a low not seen since September 2022 – a mere 3.5205%. This isn’t just a number, people, it’s a flashing red warning light.

What does this mean? Simply put, investors are increasingly betting that the Federal Reserve will be forced to cut interest rates in the not-so-distant future. Why? Because the market is bracing for a potential recession, and rate cuts are typically the Fed’s go-to move to stimulate a slowing economy. Frankly, it’s not a pretty picture.

Let’s break down some relevant background. The 2-year Treasury yield is particularly sensitive to expectations about short-term interest rate policy. A falling yield suggests investors anticipate the Fed will ease its restrictive monetary policy.

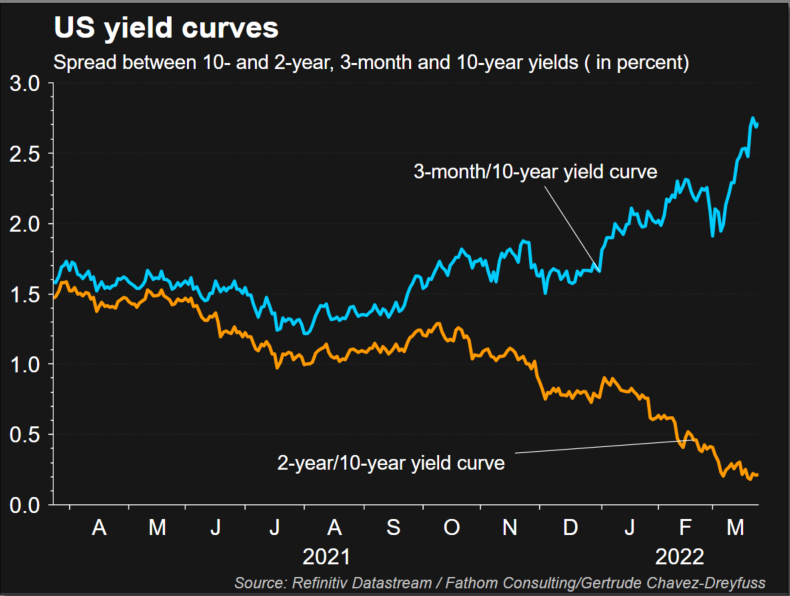

Historically, an inverted yield curve – where short-term yields exceed long-term yields – has been a remarkably accurate predictor of recessions. While we aren’t quite there yet, the narrowing gap is damn concerning.

You see, gently put, the Fed has been playing a dangerous game of inflation fighting. They’ve been hiking rates like crazy, and while they’ve made some headway on inflation, the economy is starting to feel the pinch. This yield drop suggests the market thinks the Fed will break before it truly wins, and frankly, I’m inclined to agree. It’s a bumpy road ahead, buckle up!

Understanding Yield Curves & Recessionary Signals:

A yield curve plots the yields of bonds with different maturity dates. Normally, longer-term bonds have higher yields, reflecting greater risk.

An inverted yield curve, where short-term yields exceed long-term yields, is often seen as a predictor of economic slowdowns.

This happens because investors expect future rate cuts and lower economic growth.

The 2-year Treasury yield is particularly sensitive to forecasts around the Federal Reserve’s monetary policy.

Falling yields often indicate a shift towards more dovish expectations, moving away from future rate hikes.