Alright, let’s cut through the noise. Yunnan Germanium (YMG), a key player in the germanium market, just addressed investor concerns regarding a recent and rather suspicious price jump in dioxide germanium. Prices are up nearly 7% since the beginning of April, hitting around ¥10,268 per kilogram. The question on everyone’s mind? What’s driving this surge in demand?

YMG’s response? A rather underwhelming, “No significant changes in demand for our material-grade germanium products.” Seriously?!

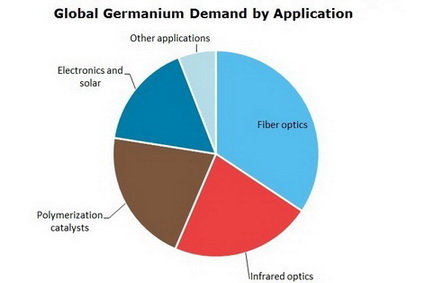

Let’s unpack this. Germanium is a critical material – a semiconductor essential to fiber optics, infrared optics, and increasingly, AI applications.

Here’s a quick primer on why this matters:

Germanium isn’t a widely-traded commodity. Supply is concentrated, making it vulnerable to manipulation. China utterly dominates the germanium supply chain, representing over 80% of refined production.

This concentrated supply chain creates systemic risk. Any disruption, even perceived, can send prices spiraling. We saw this with tin a few years ago, and frankly, this feels eerily similar.

High-purity germanium is vital for advanced applications. It enhances the performance of fiber optic cables significantly.

Furthermore, the AI boom is also driving demand. AI chips require efficient thermal management, leveraging germanium’s thermal conductivity.

So, if demand hasn’t actually increased… what gives? Is this a deliberate attempt to push prices higher? Is someone testing the waters? Or is this about a perceived future shortage? Investors should be extremely cautious. This smells fishy, and it warrants a closer look. Don’t just blindly follow the price action, dig deeper into the fundamentals – or at least, the lack thereof in this case.