Friends, fasten your seatbelts! We’re looking at a potentially explosive move in the copper market. News just broke of a sudden, unexpected halt in operations at one of the world’s largest copper mines. This isn’t some minor hiccup; this is a major disruption to global supply.

Photo source:www.crushthestreet.com

Now, before the panic buying starts, let’s break down what this means. The consensus among institutions is that this event drastically amplifies existing concerns about constrained copper supply. We’ve been talking about the tightening market for weeks, and this just throws gasoline on the fire.

Expect significant volatility. The market is already pricing in a supply squeeze, and this news could easily trigger a gap-up open. Traders will be scrambling to cover shorts and establish long positions.

Let’s dive a little deeper into why copper is so crucial. Copper is an essential metal in the global transition to green energy. Its use in electric vehicles, renewable energy infrastructure (solar, wind), and power grids is skyrocketing.

Demand from China remains a key driver, but global demand is broad-based. Political instability in key mining regions and underinvestment in new capacity exacerbate existing supply concerns.

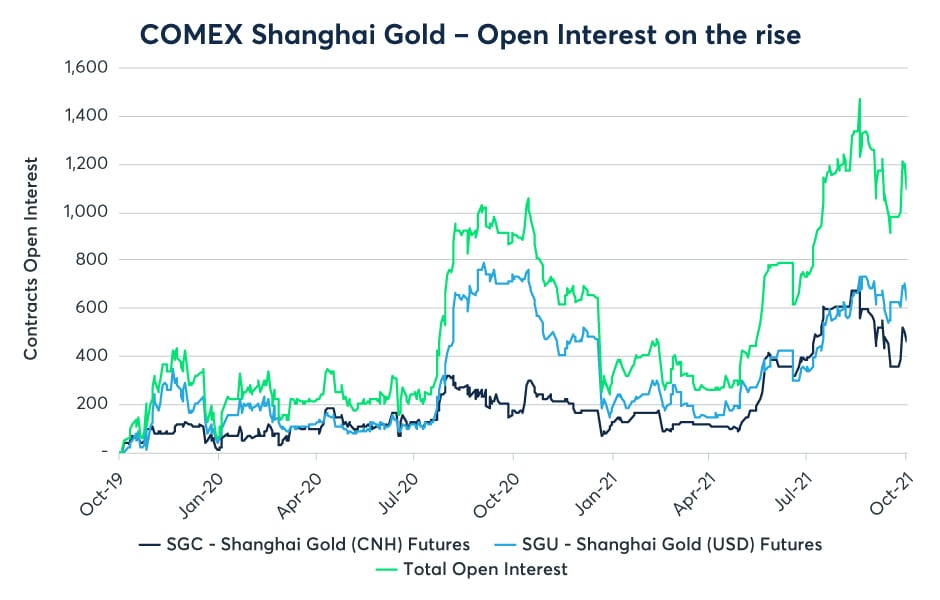

Understanding the LME (London Metal Exchange) and COMEX (Commodity Exchange) dynamics is crucial for navigating these moves. Keep a close eye on inventory levels and trading volume – they’ll tell you the real story.

This isn’t a drill, folks. This is a real-time example of how geopolitical events and supply disruptions can move markets…quickly. Stay vigilant, and remember: knowledge is your best defense.