Alright folks, let’s cut through the noise. This weekend delivered a hefty dose of reality, showcasing a world increasingly fractured by geopolitical tensions and economic maneuvering. China isn’t blinking, and the US certainly isn’t backing down.

First, China is signaling a more proactive fiscal policy response, with Finance Minister Lan Fo’an promising more assertive measures. This isn’t a subtle hint, it’s a declaration – they’re gearing up for potential headwinds. Simultaneously, Beijing vehemently denied ongoing tariff negotiations with the US, dispelling any naive hopes for a quick resolution.

China also used the IMF as a platform to call out the US’s tariff policies, arguing they are severely impacting emerging markets and developing nations. This is a direct challenge to US economic leadership and a plea for global stability – or at least, stability on their terms.

Meanwhile, President Xi Jinping stressed the importance of self-reliance and a practical approach to AI development. This dovetails with China’s wider strategy to reduce dependencies and foster indigenous innovation.

Pan Gongsheng didn’t mince words either, directly linking US tariffs to a destabilization of the global economic order. Frankly, he’s right. The interconnectedness of the global economy means unilateral actions have far-reaching consequences.

Now, let’s look at the US. The GOP’s plan to dismantle the PCAOB is…well, alarming. Seriously. This move raises serious questions about US commitment to audit oversight and investor protection. It smells of deregulation gone wild.

And the usual suspects continue to play their roles. Hamas expressed willingness to release hostages in exchange for a 5-year ceasefire, whilst skirmishes persist between India and Pakistan.

Elon Musk’s xAI is seeking a colossal $20 billion in funding, setting it up to become one of the largest startup funding rounds ever. That’s a bet on the future of AI, and Musk clearly believes his vision is worth the investment.

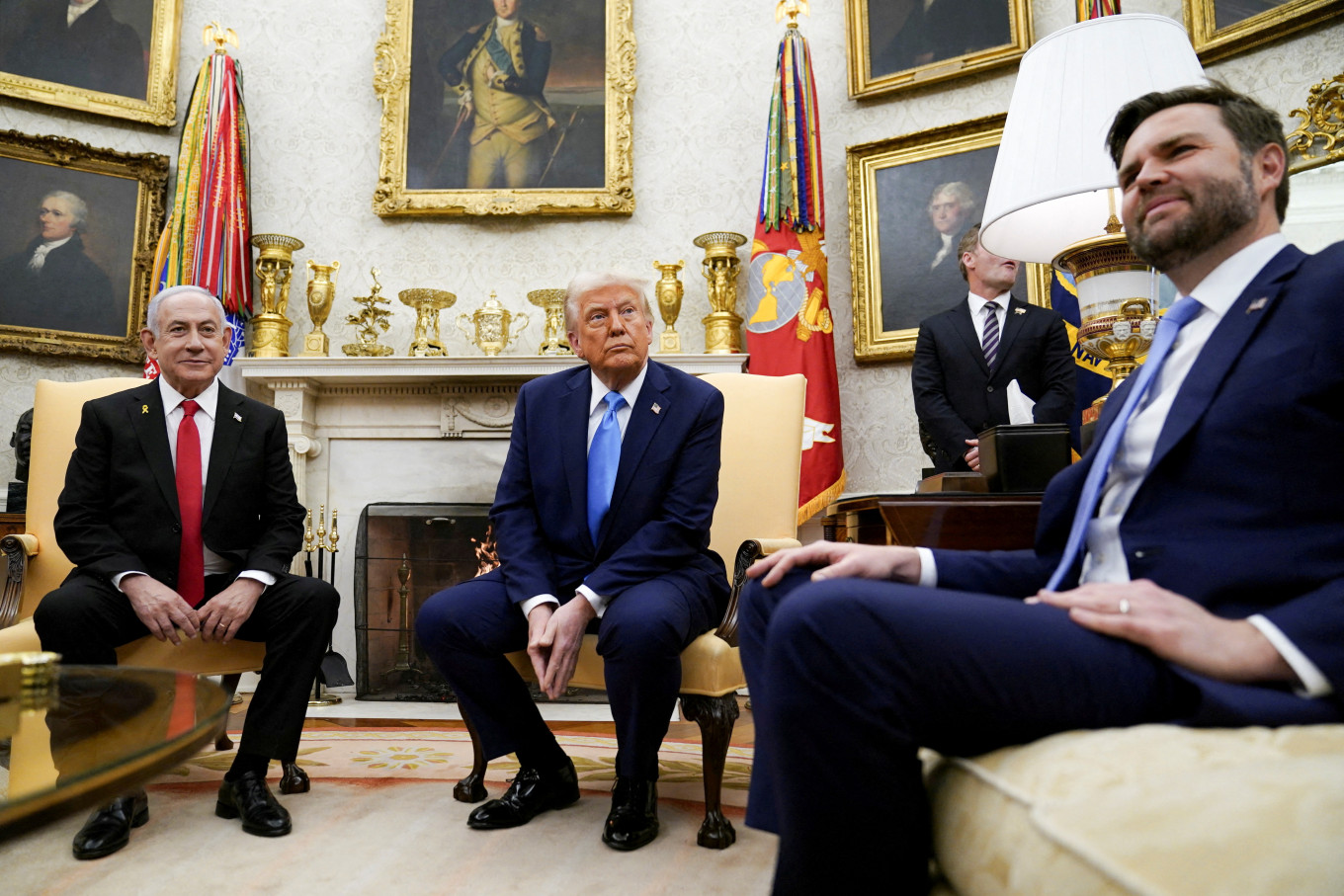

Trump, predictably, is demanding ‘substantial concessions’ from China before considering any rollback of tariffs. His rhetoric remains unchanged, a clear indication of a tough stance towards China.

The US-Iran negotiations are focused on lifting sanctions and guaranteeing Iran’s peaceful nuclear program, but trust is a major hurdle, as it always is.

On the Russia-Ukraine front, Zelenskyy met with Trump, pushing for a complete ceasefire. Russia claims to have fully reclaimed the Kursk region, a claim Ukraine disputes. Putin offers talks with no preconditions, while Trump suggests financial sanctions over attacks on civilians.

Finally, a massive explosion at an Iranian port caused casualties and disruption, impacting a critical hub for container handling. The cause remain under investigation, but it’s a reminder of vulnerabilities in global supply chains.

Deep Dive: The Power of Macro Policy Coordination

The calls for macro policy coordination, echoed by both China and Pan Gongsheng, are crucial. In a deeply intertwined global economy, one nation’s fiscal or monetary policy doesn’t exist in a vacuum.

Effective coordination involves information sharing, policy alignment, and a shared understanding of risks. Without it, we’re at the mercy of asynchronous shocks.

Think of it like this: if the US hikes rates aggressively, it can trigger capital flight from emerging markets, creating instability. A coordinated response could mitigate this impact.

However, achieving true coordination is incredibly difficult, given differing national interests and ideological perspectives. It requires trust, transparency, and a willingness to compromise – things that are in short supply these days.