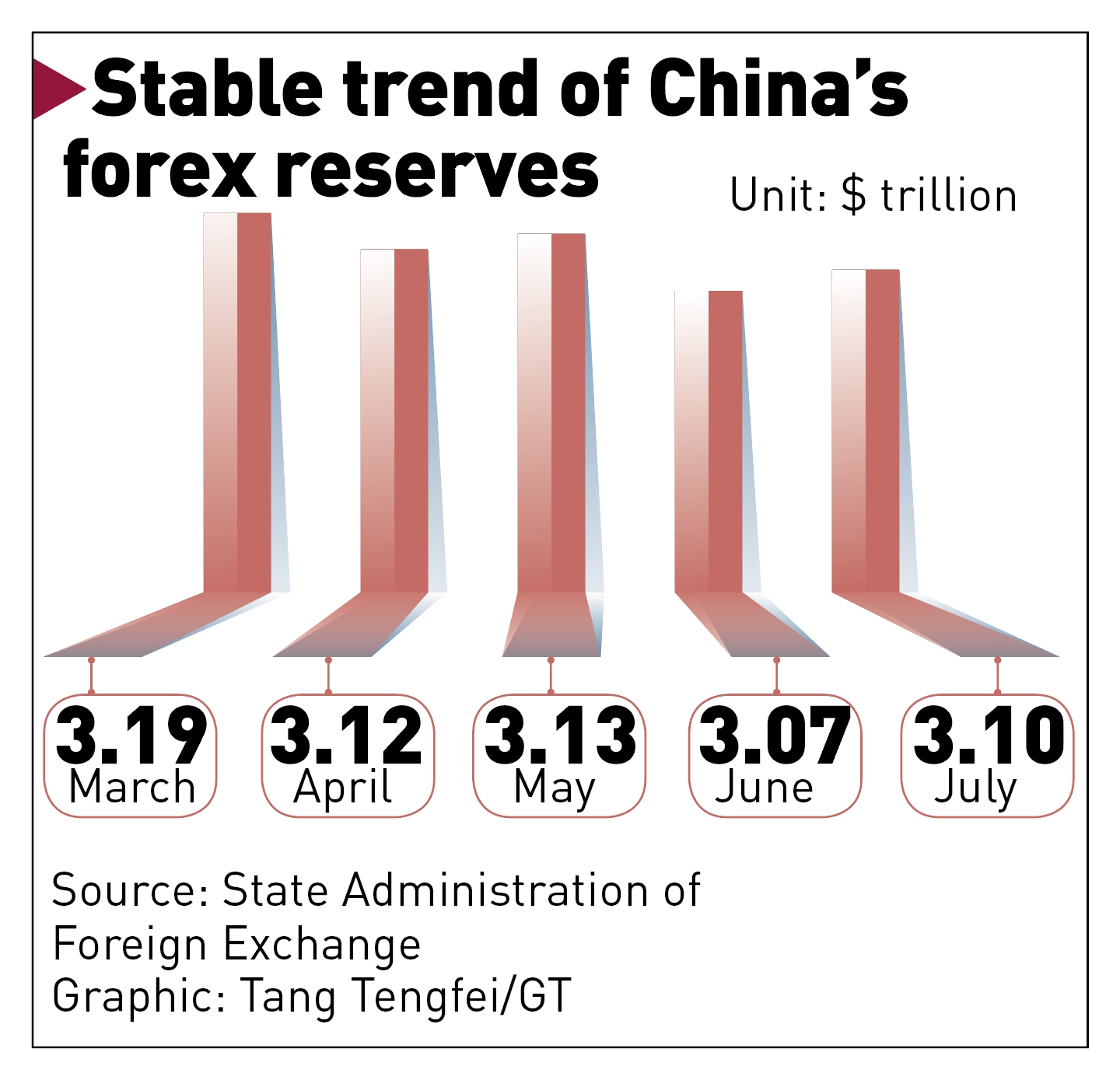

Alright, buckle up, folks, because the latest numbers out of China are… interesting, to say the least. March saw China’s foreign exchange reserves clock in at $3.240665 trillion. That’s a miss compared to the expected $3.252 trillion, and a slight bump from February’s $3.22722 trillion. Now, on the surface, it doesn’t sound like a massive deal, right? Wrong!

Let’s dive a little deeper. This isn’t just about hitting or missing a target. It’s about what this means. It suggests a continued, quiet intervention in the currency markets by the People’s Bank of China (PBOC). They’re trying to prop up the Yuan, and frankly, it’s looking like a losing battle.

Think of it like trying to hold a beach ball underwater—it takes constant effort, and eventually, your arms give out. That’s kind of where we are now with the Yuan.

Let’s talk about Forex reserves a bit. These reserves are essentially a nation’s savings account in foreign currencies, primarily US dollars. They’re crucial for everything from managing trade imbalances to intervening in currency markets. When reserves fall, it suggests the government is actively spending those dollars.

Why are they spending? To counteract devaluation pressures on the Yuan. The Yuan’s been under considerable pressure lately, thanks to a slowing economy and widening interest rate differentials with the US. This isn’t a shocker to anyone following the global economic scene.

Frankly, this subtle decline is concerning. It’s a canary in the coal mine. It’s a signal that Beijing is throwing money at the problem, and it’s not necessarily working. Don’t expect fireworks, but pay attention – this is a slow-burn story that could get a lot hotter. This data screams a cautious outlook on China’s economic stability. It is, to put it bluntly, a bit of a shitshow brewing.

Understanding Forex Reserves:

Forex reserves represent a country’s holdings of foreign currencies, gold, and other reserve assets. They’re vital for maintaining economic stability.

A decline in reserves often indicates intervention in currency markets to resist appreciation or depreciation. Such interventions are costly.

The level of reserves offers insight into a country’s external financial position and ability to meet its international obligations.

Changes in reserves are closely monitored by investors and policymakers as an indicator of economic health and potential risks.