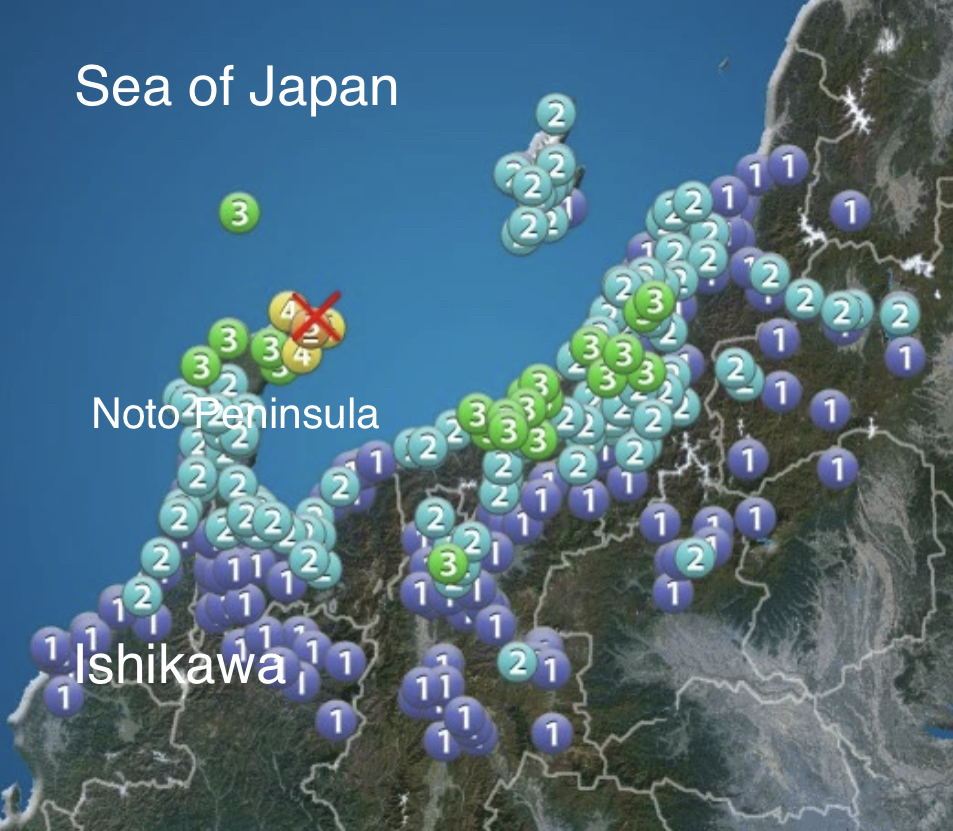

Alright, folks, let’s talk about what’s happening in Nagano, Japan. Forty-seven earthquakes…in one night! A 5.1 magnitude quake hit on April 18th, rippling through the region with a ‘5 weak’ intensity – the strongest felt since the devastating Noto Peninsula quake earlier this year. This isn’t just a shiver, it’s a wake-up call.

It’s easy to dismiss this as just another tremor in a seismically active country, and Japan is used to earthquakes, believe me. But here’s where it gets dicey. The Japan Meteorological Agency isn’t downplaying it. They’re forecasting a high probability of similar events in the next week and, critically, haven’t ruled out the possibility of a larger quake.

What does this mean? Japan sits on the Pacific Ring of Fire, a horseshoe-shaped zone known for intense volcanic and seismic activity. This quake happened near a known fault line, meaning the stress is building.

The ‘5 weak’ intensity is significant. It’s strong enough to rattle buildings, topple objects, and frankly, scare the living daylights out of people. It’s a level where you really feel the earth move.

Let’s get a little technical. Earthquake intensity scales (like the Shindo scale used in Japan) measure the effects of an earthquake at a specific location. Magnitude, like the 5.1 we saw, measures the energy released at the source. These are different things!

Here’s what you need to understand: aftershocks are normal, but 47 of them? That suggests significant ongoing adjustments beneath the surface. And the JMA’s warning? That’s not hyperbole. Preparing for the possibility of further tremors, and even a larger event, isn’t paranoia – it’s prudence. Stay vigilant, people. This situation bears close watching.