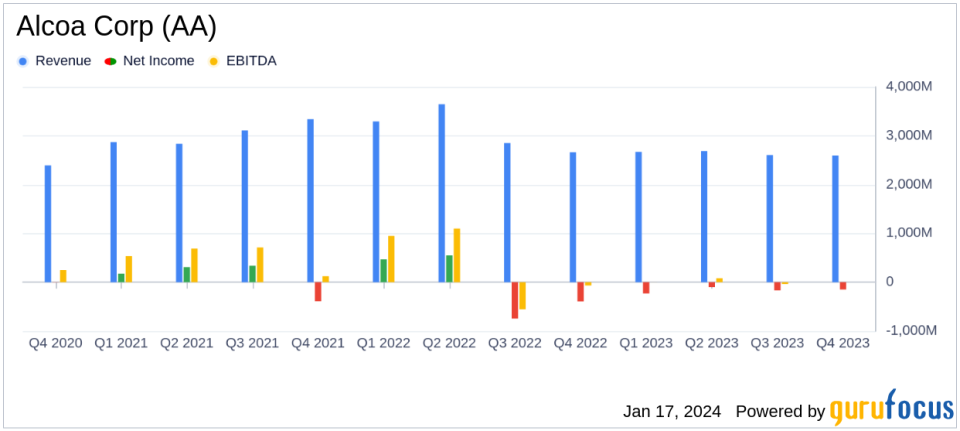

Hold on to your hats, folks! Alcoa (AA.N) just dropped a dual blow. They’re sticking to their previously stated 2025 alumina production and shipment forecasts – essentially, no exciting growth on the horizon. But that’s not the worst of it. The real kicker? A hefty $90 million hit to their aluminum segment this quarter, all thanks to those pesky Section 232 tariffs levied by the U.S. on Canadian aluminum imports.

Let’s break down why this matters. Section 232 tariffs, originally intended to protect domestic aluminum producers, end up hurting not just Alcoa’s bottom line but also downstream industries reliant on affordable aluminum. It’s a classic case of protectionism backfiring.

Now, some might say $90 million isn’t catastrophic for a company like Alcoa, and they’re not entirely wrong. But it’s a substantial dent and a clear signal that the geopolitical landscape is throwing some serious curveballs. These tariffs add uncertainty, and uncertainty is the enemy of investment.

Expanding on Section 232 Tariffs and Aluminum Dynamics:

Section 232 tariffs, invoking national security concerns, allow the U.S. to impose duties on imports of steel and aluminum. The stated goal is to bolster domestic production.

However, these tariffs often disrupt established supply chains, increase costs for manufacturers who rely on these materials, and can provoke retaliatory measures from other countries.

Alumina, a key component in aluminum production, is itself subject to market volatility influenced by factors like bauxite supply, energy costs, and global demand.

Canadian aluminum is a significant source for the U.S. market, and introducing tariffs creates artificial price distortions and decreases overall market efficiency. This situation highlights the complex interplay between trade policy and industry performance.