Let’s be blunt: your network is your net worth, and Warren Buffett just hammered that point home. The Oracle of Omaha, speaking recently, delivered a crucial piece of advice for young investors – and frankly, anyone striving for success. It’s not about what you know, it’s about who you know, and crucially, who you choose to learn from.

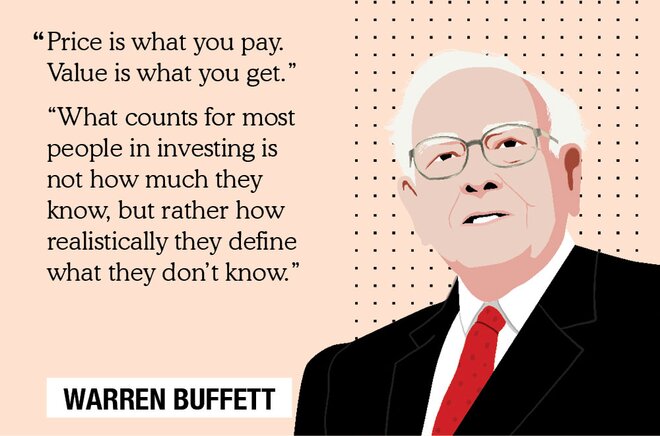

Photo source:www.ruleoneinvesting.com

Buffett emphasized, “You should associate with people who are better than you.” It’s a simple concept, almost laughably so, yet profoundly impactful. You become the average of the five people you spend the most time with – a principle often attributed to Jim Rohn, and one Buffett clearly lives by.

This isn’t merely about social climbing. It’s about osmosis. Exposure to superior intellect, disciplined thinking, and a robust understanding of markets will inevitably rub off on you. Surrounding yourself with mediocrity breeds stagnation, while association with excellence fuels growth.

Let’s dive a little deeper into this principle, with a few key concepts.

Firstly, consider the power of mentorship. Finding a seasoned investor who’s willing to share insights isn’t just helpful, it’s invaluable. They’ve weathered storms you haven’t even seen on the horizon.

Secondly, active participation in insightful financial communities is crucial. Online forums, investment clubs – these spaces foster learning and debate. Just ensure it’s quality discussion, not just echo chambers of speculation!

Thirdly, study individuals who consistently outperform. Read their books, analyze their strategies, and try to decipher their thought processes. Don’t just copy, understand.

Finally, remember that ‘better’ doesn’t necessarily mean wealthier. It means individuals with superior logic, ethics, and a long-term investment horizon. Don’t chase hype; chase wisdom.