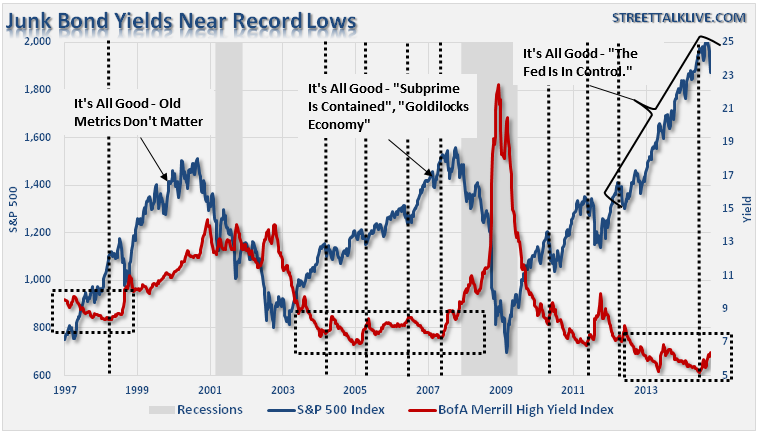

Alright folks, hold onto your hats! The market’s throwing a proper tantrum, and it’s not a pretty sight. We’re seeing the spread between US junk bonds and US Treasuries widen to a gut-wrenching 401 basis points – the highest level in 17 months. What does this mean in plain English? It means investors are seriously spooked.

Think of it like this: junk bonds are riskier investments, so they usually offer higher yields to compensate. When investors get worried about the economy, they dump these riskier assets and flock to the safety of US Treasuries, driving their prices up and yields down. This widens the spread – and right now, that spread is yelling ‘recession!’ at the top of its lungs. Honestly, it’s a bloodbath out there.

Let’s break down what’s fueling this fire. The biggest culprit? Those damned trade wars. The constant back-and-forth with tariffs is creating a massive cloud of uncertainty. Businesses hate uncertainty, and investors really hate it.

Knowledge Point Expansion:

Credit spreads reflect the difference in yield between two debt instruments. A wider spread usually indicates increased risk perception. Investors demand a larger premium for holding riskier assets.

Trade wars negatively impact corporate earnings. Increased import costs and potential retaliatory tariffs squeeze profit margins, causing concern.

The yield on US Treasury bonds is often a benchmark for risk-free rates. Economic slowdowns typically drive investors towards these safe havens.

Junk bonds, or high-yield bonds, are issued by companies with lower credit ratings. They carry higher risk but also potentially higher returns. Current spread hints a potential default risk rising.

Monitoring credit spreads is a crucial tool for assessing market sentiment and predicting economic downturns. It’s a pain in the ass, but important!