Friends, buckle up! Argentina, a heavyweight in the global grain market, is currently a hot mess. We’re seeing a flurry of ‘reforms’ touted by the new administration, promising a shake-up in the agricultural sector. But let’s cut through the noise – the reality on the ground is far from rosy.

Grain sales are plunging at a terrifying rate, hitting a ten-year low. Yes, you read that right. Despite all the promises, farmers are holding back, and demand is clearly wavering. This isn’t just a blip; it’s a warning sign.

Harvest progress is also lagging, severely impacting supply. Think weather concerns combined with farmer hesitancy—it’s a perfect storm brewing in the Pampas! The delay adds uncertainty to the overall production estimates.

What’s driving this slowdown? A complex interplay of factors, including farmer distrust arising from the previous government’s interventionist policies and fears over the new government’s intentions. Currency controls and export taxes aren’t helping either.

Now, let’s dive deeper into the underlying dynamics.

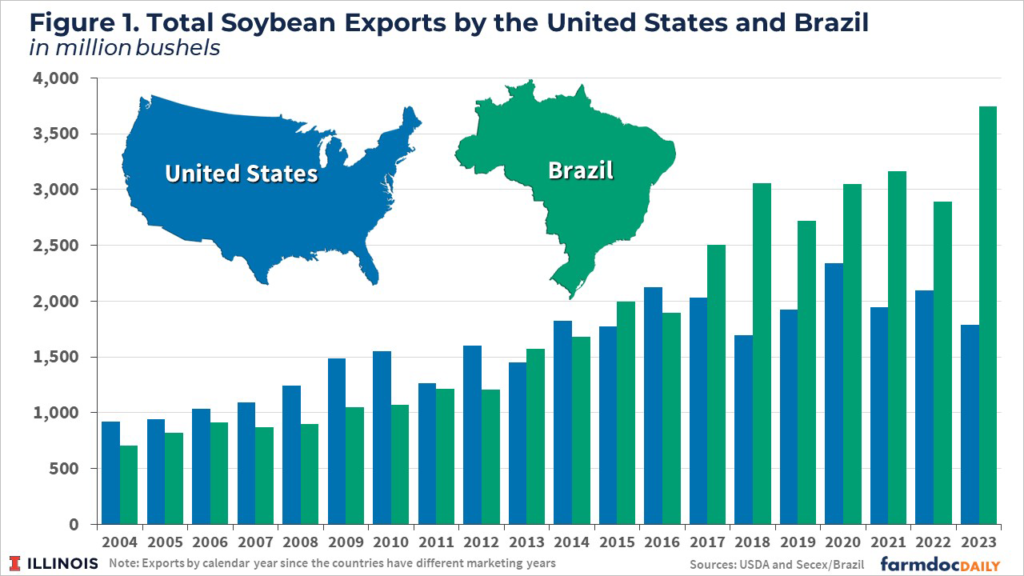

Argentina is a major exporter of soybeans and corn, significantly influencing global prices. Its trade policies ripple throughout the agricultural world. Recent policy shifts—while intended to stimulate exports—have inadvertently cooled farmer enthusiasm.

Historically, Argentina’s grain sector has faced volatility due to policy changes. Frequent intervention creates uncertainty and discourages long-term investment. This current situation reinforces that pattern.

We’re monitoring the unfolding situation closely. The market is desperate for clarity. Will the government find a way to regain farmer confidence? When will we see a rebound in soybean and corn markets? That’s the million-dollar question. Stay tuned for ongoing updates and my unfiltered analysis!